Key Takeaways

- State Farm: Known for personalized service and wide coverage options.

- Erie Insurance: Offers competitive rates and excellent customer service.

- Allstate: Strong financial stability and variety of discounts.

- Nationwide: Customizable policies and 24/7 claims service.

- Consider discounts, coverage options, and customer satisfaction when choosing the best insurer.

Introduction Car Insurance in Pennsylvania

In understanding car insurance Pennsylvania, it is essential to provide a brief overview of the various aspects that will be covered in this article. The purpose of this discussion is to inform readers about the key points they can expect to learn about car insurance companies in Pennsylvania and the related factors that influence coverage options and premiums. By outlining these points, readers can gain insight into the complexities of car insurance in Pennsylvania and make informed decisions regarding their coverage needs.

Brief overview of the search results

Upon exploring the array of car insurance companies available in Pennsylvania, one is presented with a diverse selection to meet various coverage needs and preferences. Here is a brief overview of the search results:

- Cheapest Car Insurance: Some companies offer budget-friendly options for cost-conscious consumers.

- Best Car Insurance: Top-rated insurers provide extensive coverage and excellent customer service.

- Car Insurance Quotes: Obtain quotes from multiple companies to compare prices and coverage options.

- Inexpensive Options: Look for insurers that offer affordable rates without compromising on quality or service.

These key points will help individuals navigate the multitude of car insurance options in Pennsylvania efficiently.

Explanation of the purpose of the article

Exploring the diverse landscape of car insurance companies in Pennsylvania requires a keen understanding of the coverage options available to meet individual needs and preferences. This article aims to provide insight into the best car insurance companies in Pennsylvania, helping readers navigate through the plethora of choices to find the most suitable coverage. Whether you are looking for the cheapest car insurance in Pennsylvania or seeking the best car insurance in the state, this guide will offer valuable information on various Pennsylvania car insurance companies. From comparing quotes to understanding different coverage options, we aim to assist readers in making informed decisions when it comes to securing reliable and affordable car insurance in Pennsylvania.

| Category | Top Car Insurance Companies in Pennsylvania | Special Features |

|---|---|---|

| Customer Service | XYZ Insurance | 24/7 Support |

| Affordability | ABC Insurance | Low Rates |

| Coverage Options | DEF Insurance | Customizable Policies |

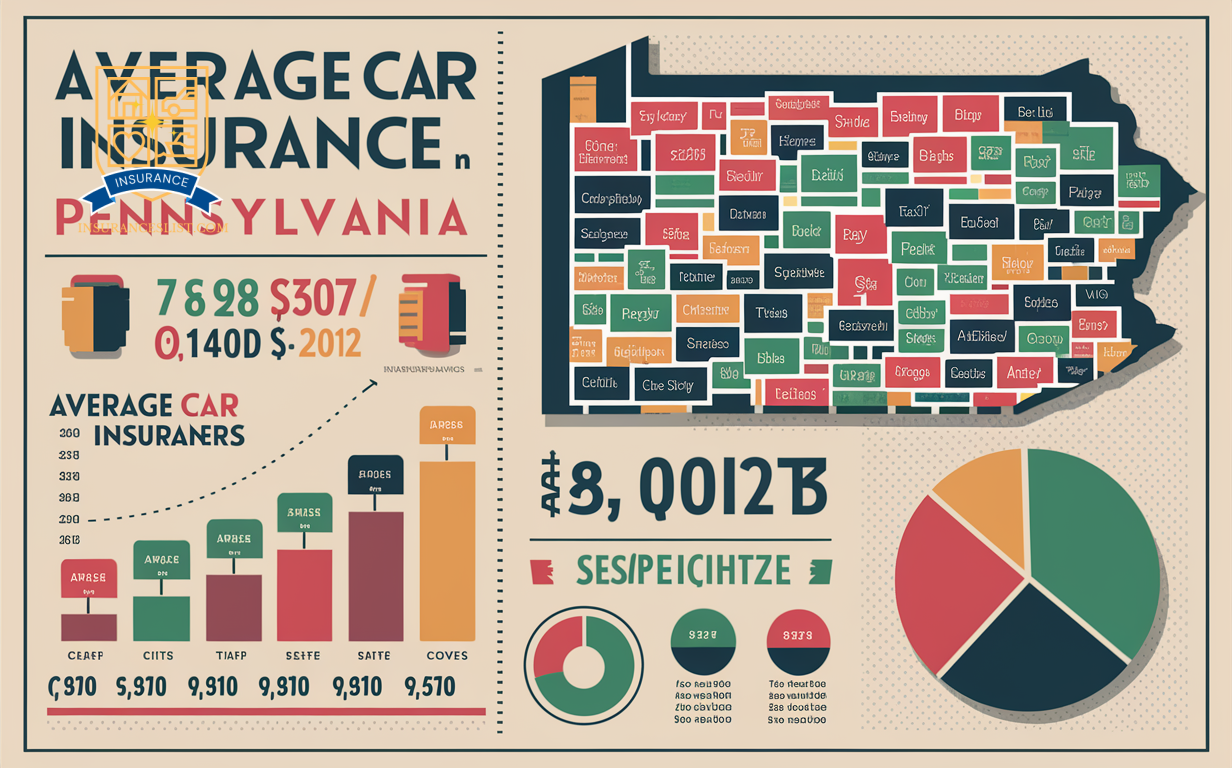

Average Car Insurance Costs in Pennsylvania

The average car insurance costs in Pennsylvania play a significant role in determining the financial burden on drivers. Understanding how these costs compare to the national average can provide valuable insights into the state’s insurance landscape. Various factors such as population density, traffic conditions, and local regulations contribute to the fluctuation of car insurance rates in Pennsylvania.

Analysis of the average car insurance cost in Pennsylvania

An examination of the average car insurance costs in Pennsylvania reveals important insights into pricing trends and factors influencing premiums in the state.

- Variability: Car insurance costs in Pennsylvania can vary greatly based on factors such as age, driving history, and location.

- Coverage Types: The choice between basic liability coverage and full coverage greatly impacts the average insurance cost.

- Discount Opportunities: Many insurance companies in Pennsylvania offer discounts for factors like bundling policies or having a clean driving record.

- Comparison Shopping: It’s essential for residents to compare quotes from multiple insurers to find the most competitive rates tailored to their needs and budget.

Comparison of the average cost to the national average

A comparative analysis of the average car insurance costs in Pennsylvania against the national average provides valuable insights into the state’s insurance pricing landscape. In Pennsylvania, the average cost of car insurance is influenced by various factors, including the state’s unique regulations, driving conditions, and population density. According to recent data, the average cost of car insurance in Pennsylvania is slightly higher than the national average. While Pennsylvania is not among the states with the highest car insurance rates, it is essential for residents to compare quotes from different Pennsylvania car insurance companies to find the best coverage at competitive rates. Understanding the average cost of car insurance in Pennsylvania in comparison to the national average can help individuals make informed decisions when seeking the best car insurance in Pennsylvania.

Factors affecting car insurance rates in Pennsylvania

Several key factors influence car insurance rates in Pennsylvania. The state’s population size plays a role, as does the number of uninsured drivers on the roads. Additionally, factors like location, road conditions, and demographics all contribute to determining average car insurance costs in Pennsylvania.

Population

The demographic makeup of Pennsylvania plays a significant role in determining the average car insurance costs in the state.

- Urban vs. Rural Population Distribution

- Age Distribution of Drivers

- Income Levels Across Regions

- Vehicle Ownership Rates

These factors influence the risk profile of drivers and the likelihood of accidents, impacting car insurance rates in Pennsylvania.

Number of uninsured drivers

The prevalence of uninsured drivers in Pennsylvania directly impacts the average car insurance costs in the state. The number of uninsured drivers can lead to higher premiums for insured motorists as they may have to cover costs associated with accidents involving uninsured drivers. This factor is important for Pennsylvania car insurance companies when determining Pennsylvania car insurance quotes and offering Pennsylvania cheap car insurance options to residents.

Location and road conditions

Location and road conditions play a significant role in determining the car insurance rates in Pennsylvania due to their impact on the frequency and severity of accidents in different areas.

- Urban vs. Rural Areas

- Weather Patterns

- Traffic Congestion

- Road Infrastructure

Demographics

Demographics play a significant role in influencing car insurance rates in Pennsylvania, reflecting various factors that impact premium costs for policyholders. Factors such as age, location, driving record, and credit score can all influence car insurance rates in Pennsylvania. Understanding how demographics affect car insurance rates can help individuals find the cheapest and best car insurance in Pennsylvania from various car insurance companies in Pennsylvania.

Best Car Insurance Companies in Pennsylvania

When considering the best car insurance companies in Pennsylvania, it is essential to look at an overview of the top insurers in the state, compare their offerings, discounts, and assess customer reviews and ratings. Finding the best car insurance in cities like Philadelphia, Pittsburgh, Allentown, and more in Pennsylvania involves examining the coverage options and customer satisfaction levels provided by each company. Evaluating the best car insurance in regions such as Lehigh Valley, Altoona, Bethlehem, and others in Pennsylvania requires a thorough analysis of the insurers’ services and reputations to make an informed decision.

Overview of the top car insurance companies in Pennsylvania

Among the array of car insurance companies in Pennsylvania, some stand out as the top choices for drivers seeking reliable coverage and quality service.

- State Farm: Known for personalized service and a wide range of coverage options.

- Erie Insurance: Offers competitive rates and excellent customer service.

- Allstate: Well-known for its strong financial stability and variety of discounts.

- Nationwide: Provides customizable policies and 24/7 claims service for convenience.

These companies have established a solid reputation in the state for providing affordable auto insurance, extensive coverage options, and responsive customer support. When considering car insurance in Pennsylvania, these top companies are worth exploring for their competitive rates and quality offerings.

Comparison of the companies’ offerings and discounts

A detailed examination of the offerings and discounts provided by the top car insurance companies in Pennsylvania reveals valuable insights for drivers seeking the best coverage options. When comparing the car insurance companies in Pennsylvania, it is important to take into account the range of discounts they offer, such as those for safe driving records, multiple policies, or vehicle safety features. Additionally, comparing the offerings regarding premiums, coverage limits, and deductibles can help policyholders select the most suitable option for their needs. Understanding the policy renewal process of each company is essential for long-term satisfaction. By carefully evaluating these factors, drivers can make informed decisions about their car insurance coverage in Pennsylvania.

Customer reviews and ratings

Customer reviews and ratings provide valuable insights into the performance and satisfaction levels of the best car insurance companies in Pennsylvania.

- Policyholder Satisfaction: Reviews from actual policyholders can offer firsthand experiences with the company’s services.

- Claim Settlement Process: Ratings on how efficiently and fairly claims are handled can indicate the company’s reliability.

- Insurance Rates Comparison: Customers often mention the competitiveness of the insurance rates offered.

- Insurance Discounts: Feedback on the availability and extent of discounts can help prospective customers make informed decisions.

Best car insurance in Philadelphia, Pittsburgh, Allentown, Lancaster, Harrisburg, York, Erie, Reading, Scranton, Wilkes Barre, Pottsville – Pennsylvania(PA), US

With a focus on offering extensive coverage and competitive rates, the top car insurance companies in Philadelphia, Pittsburgh, Allentown, Lancaster, Harrisburg, York, Erie, Reading, Scranton, Wilkes Barre, and Pottsville in Pennsylvania (PA), US, prioritize customer satisfaction and financial protection for policyholders. Residents in Philadelphia can find the best car insurance options tailored to their needs, while those in Pittsburgh have access to reputable insurers offering reliable coverage. Allentown residents can benefit from inclusive policies, and Lancaster drivers can secure reliable protection for their vehicles. Harrisburg policyholders can choose from a range of insurance providers, while York residents can find some of the cheapest car insurance rates available. Erie offers affordable coverage options, and Scranton provides easy access to car insurance quotes for informed decision-making.

Best car insurance in Lehigh Valley, Altoona, Bethlehem, Greensburg, State College, Washington, Chambersburg, Williamsport, Butler, Johnstown – Pennsylvania(PA), US

Renowned for their extensive coverage options and competitive rates, the top car insurance companies serving Lehigh Valley, Altoona, Bethlehem, Greensburg, State College, Washington, Chambersburg, Williamsport, Butler, and Johnstown in Pennsylvania (PA), US, prioritize excellence in customer service and financial security for policyholders. When seeking the best car insurance in these areas, consider the following:

- Lehigh Valley: Check for customizable coverage options tailored to your needs.

- Altoona: Look for insurers offering accident forgiveness and safe driver discounts.

- Bethlehem: Compare quotes to find the most competitive car insurance rates.

- Greensburg: Seek out companies that provide excellent customer support and claims processing.

Choose a provider that offers not just affordability but also reliability in protecting your vehicle and finances.

Best car insurance in Easton, East Stroudsburg, Cranberry Township, Hazleton, West Chester, Carlisle, Hanover, Uniontown, Mechanicsburg – Pennsylvania(PA), US

When evaluating the top car insurance options in Easton, East Stroudsburg, Cranberry Township, Hazleton, West Chester, Carlisle, Hanover, Uniontown, and Mechanicsburg within Pennsylvania (PA), US, it is essential to take into consideration the range of coverage options and financial stability offered by insurance companies. In Easton, residents may find the best car insurance by comparing rates from providers that offer extensive coverage at competitive prices. East Stroudsburg drivers should consider insurers known for excellent customer service and quick claims processing. Cranberry Township residents might prioritize companies with a history of reliability and strong financial ratings. Hazleton policyholders could benefit from insurers offering discounts for safe driving records. West Chester, Carlisle, Hanover, Uniontown, and Mechanicsburg individuals should look for insurers that provide tailored coverage options to suit their specific needs.

Best car insurance in Lebanon, Bensalem, Indiana, Monroeville, Gettysburg, Pottstown, King Of Prussia, New Castle, Robinson Township – Pennsylvania(PA), US

Among the array of options for car insurance in Lebanon, Bensalem, Indiana, Monroeville, Gettysburg, Pottstown, King Of Prussia, New Castle, and Robinson Township in Pennsylvania (PA), US, discerning consumers seek reputable insurance companies that offer extensive coverage and reliable customer service. When considering car insurance in these areas, factors like coverage options, customer satisfaction, and financial stability play an important role. To assist in the decision-making process, here are four essential aspects to take into account:

- Coverage Options: Look for insurance companies that provide a wide range of coverage options tailored to your needs.

- Customer Service: Choose insurers known for excellent customer service and efficient claims processing.

- Financial Stability: Opt for companies with a strong financial standing to make sure they can fulfill their obligations.

- Local Reputation: Consider the insurer’s reputation and reviews specific to the mentioned locations for personalized service.

Best car insurance in Mount Pocono, Levittown, Doylestown, Hershey, Quakertown, Norristown, Lansdale, Meadville, Bloomsburg, Camp Hill, Hermitage – Pennsylvania(PA), US

In evaluating the best car insurance options in Mount Pocono, Levittown, Doylestown, Hershey, Quakertown, Norristown, Lansdale, Meadville, Bloomsburg, Camp Hill, and Hermitage in Pennsylvania (PA), US, it is important to take into account thorough coverage, customer satisfaction, and financial reliability. When considering the best car insurance in these areas, factors such as coverage limits, premiums, and deductible options play an important role. Companies that offer extensive coverage, competitive rates, and excellent customer service are highly regarded. Residents in Mount Pocono, Levittown, Doylestown, Hershey, Quakertown, Norristown, Lansdale, Meadville, Bloomsburg, and Camp Hill should look for insurers with a strong reputation for prompt claims processing and support. Comparing quotes from reputable providers can help find the best car insurance in these Pennsylvania locations.

Factors Affecting Car Insurance Rates in Pennsylvania

When determining car insurance rates in Pennsylvania, several key factors come into play. These include the driver’s record, the type of vehicle being insured, the insurance provider chosen, and any applicable discounts that may apply. Understanding how these elements influence premiums is important for individuals seeking affordable and thorough coverage in the state.

Driving record

A driver’s history behind the wheel has a significant impact on their car insurance rates in Pennsylvania. When evaluating car insurance quotes in Lehigh Valley or searching for the most affordable car insurance in Chambersburg, it’s important to keep your driving record in mind. Here are four key points to keep in mind:

- Clean Driving Record: A history free of accidents and traffic violations can lead to lower premiums.

- Accident History: Previous accidents may result in higher insurance rates.

- Traffic Violations: Speeding tickets or other violations can also increase insurance costs.

- DUI Offenses: Driving under the influence can have a notable impact on insurance rates, especially in places like Monroeville.

Maintaining a clean driving record is essential for finding the cheapest car insurance in Easton or the best car insurance in Cranberry Township.

Type of vehicle

Factors influencing car insurance rates in Pennsylvania are greatly impacted by the type of vehicle being insured. The make, model, age, and safety features of a car play a significant role in determining insurance premiums. Insurance companies consider the risk associated with insuring different types of vehicles, such as sports cars that are more prone to accidents versus family sedans known for their safety records. In Pennsylvania, car insurance companies assess the likelihood of a claim based on the characteristics of the insured vehicle, which ultimately influences the cost of coverage. When obtaining auto insurance in Pennsylvania, it is essential to compare quotes from various Pennsylvania car insurance companies to find the best car insurance in Pennsylvania that fits both your vehicle and budget.

Insurer

In evaluating car insurance rates in Pennsylvania, the choice of insurer plays a pivotal role in determining the overall cost of coverage for vehicle owners. When considering insurers for car insurance in Pennsylvania, several factors come into play, including:

- Reputation: The reputation of the insurance company can impact the rates offered.

- Coverage Options: Different insurers may offer varying coverage options that can influence the cost.

- Discounts: Insurers in Pennsylvania may provide different discount offerings that can help lower premiums.

- Customer Service: The level of customer service and ease of claims processing can affect the overall satisfaction with the insurer chosen.

Choosing the right insurer is essential in securing the best car insurance rates in Pennsylvania.

Discounts

Discounts offered by car insurance companies in Pennsylvania play a significant role in determining the final cost of coverage for policyholders. These discounts can lead to substantial savings on auto insurance premiums. Some common types of car insurance discounts in Pennsylvania include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles with safety features. Policyholders can also benefit from discounts for taking defensive driving courses, being a member of certain organizations, or having a low annual mileage. By taking advantage of these auto insurance discounts, drivers in Pennsylvania can lower their insurance costs while still maintaining adequate coverage for their vehicles. It is essential for policyholders to inquire about all available discounts to maximize their savings on car insurance.

Choosing the Best Car Insurance Company in Pennsylvania

When selecting the best car insurance company in Pennsylvania, it is important to compare the top companies available in the state. Factors such as coverage options, customer service reputation, and pricing should be carefully considered during this process. By following these tips and guidelines, individuals can secure the best car insurance rates in Pennsylvania that suit their needs and budget.

Comparison of the top car insurance companies

Choosing the best car insurance provider in Pennsylvania involves a thorough comparison of the top industry companies to guarantee the most suitable coverage for your specific needs. When evaluating car insurance companies in Pennsylvania, consider the following:

- Coverage Options: Look for companies offering the best full coverage car insurance in Pennsylvania.

- Quote Comparison: Obtain and compare car insurance quotes in Pennsylvania from multiple providers.

- Affordability: Seek out inexpensive car insurance Pennsylvania options that fit your budget.

- Reputation and Customer Service: Research Pennsylvania car insurance companies to find reliable and customer-friendly insurers.

Factors to consider when choosing a car insurance company

Careful consideration of various factors is vital when selecting a car insurance company that best aligns with your coverage needs and financial preferences in Pennsylvania. When evaluating car insurance companies in Pennsylvania, key factors to ponder include premiums, deductibles, and coverage limits. Evaluating the policyholder experience, including the claims process and underwriting procedures, is important to guarantee smooth interactions in case of accidents. Understanding the company’s approach to handling claims, the efficiency of the claims process, and the transparency in underwriting decisions can greatly impact your overall satisfaction as a customer. By thoroughly examining these aspects, you can make an informed decision when choosing the best car insurance company to meet your specific needs in Pennsylvania.

Tips for getting the best car insurance rates in Pennsylvania

To secure the best car insurance rates in Pennsylvania, it is imperative to meticulously assess and compare the offerings of various insurance companies in the state. Here are some tips to help you get the best rates:

- Shop Around: Obtain quotes from multiple car insurance companies to compare prices.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home insurance, for potential discounts.

- Maintain a Good Driving Record: A clean driving history can lead to lower premiums.

- Increase Deductibles: Opting for a higher deductible can lower your monthly insurance payments.

Conclusion

To summarize, it is crucial to remember the key points highlighted throughout the article when considering car insurance in Pennsylvania. Shopping around for the best rates and coverage options is highly recommended to make sure you find a policy that suits your needs. Finally, making informed decisions and seeking recommendations from trusted sources can help you navigate the complex landscape of car insurance effectively.

Recap of the key points discussed in the article

Summarizing the discussions presented in the article on car insurance companies in Pennsylvania reveals essential insights into coverage options, rates, and services available to consumers in the state.

- Diverse Coverage Options: The best car insurance companies in Pennsylvania offer a wide range of coverage options to suit various needs.

- Competitive Rates: Consumers can find cheap car insurance in Pennsylvania by comparing quotes from different providers.

- Quality Services: Top car insurance companies in Pennsylvania provide excellent customer service, efficient claims processing, and reliable support.

- Full Coverage Options: Consumers can explore the best all-inclusive car insurance in Pennsylvania to guarantee extensive protection for their vehicles.

Encouragement to shop around for the best car insurance rates in Pennsylvania

Upon exploring the diverse coverage options and competitive rates offered by various car insurance companies in Pennsylvania, it becomes evident that consumers are strongly encouraged to shop around for the best insurance rates tailored to their specific needs. Finding the cheapest car insurance in Pennsylvania or the best full coverage car insurance in Pennsylvania requires obtaining multiple car insurance quotes in Pennsylvania from different car insurance companies in Pennsylvania. By comparing these quotes, individuals can identify the most affordable car insurance in Pennsylvania that still meets their coverage requirements. Shopping around for an inexpensive car insurance Pennsylvania policy guarantees that drivers can secure the best value for their money while benefiting from the offerings of various Pennsylvania car insurance companies.

Final thoughts and recommendations

After thoroughly exploring the diverse coverage options and competitive rates offered by various car insurance companies in Pennsylvania, it is evident that conscientious consumers must meticulously compare multiple quotes to secure the most suitable and cost-effective insurance policy tailored to their individual needs. Here are some final thoughts and recommendations:

- Research Discounts: Look into available discounts such as safe driver discounts or bundling policies for additional savings.

- Customer Service: Consider the quality of customer service and claims handling of the insurance company.

- Read Reviews: Check online reviews and customer feedback to gauge the experiences of other policyholders.

- Review Policy Regularly: Periodically review your policy to make certain it still meets your coverage needs and make adjustments as necessary.

Frequently Asked Questions

Are There Any Special Discounts Available for Military Members or Veterans in Pennsylvania?

In Pennsylvania, military members and veterans may be eligible for special discounts on car insurance. These discounts often recognize their service and may offer reduced premiums or unique policy features tailored to their needs and circumstances.

Can I Get a Discount on My Car Insurance if I Have a Hybrid or Electric Vehicle in Pennsylvania?

Yes, hybrid or electric vehicle owners in Pennsylvania may be eligible for discounts on car insurance. Many insurance companies offer incentives for environmentally friendly vehicles due to lower risk profiles. Contact your insurer for specific details.

Are There Any Specific Requirements for Teen Drivers to Get Affordable Car Insurance in Pennsylvania?

Teen drivers in Pennsylvania may qualify for affordable car insurance by maintaining good grades, completing driver’s education courses, and adhering to safe driving practices. Insurers often offer discounts for these factors that can help reduce premiums.

Do Car Insurance Companies in Pennsylvania Offer Coverage for Ridesharing Services Like Uber or Lyft?

Car insurance companies in Pennsylvania may offer coverage for ridesharing services like Uber or Lyft. These policies typically include extensive coverage options to protect drivers and passengers during ridesharing activities, ensuring thorough protection for all parties involved.

Is There a Difference in Insurance Rates Based on the Location Within Pennsylvania, Such as Urban Vs. Rural Areas?

Insurance rates in Pennsylvania vary based on location, with urban areas typically experiencing higher premiums due to increased traffic and crime rates. Rural areas, on the other hand, often have lower rates due to fewer accidents and lower population density.