Disability Insurance

Disability insurance is essential for financial planning, offering a safety net in case of illness or injury by replacing lost wages to maintain financial security. There are various types, including short-term and long-term, each with specific eligibility criteria and coverage options tailored to different needs. Understanding this insurance involves knowing benefit amounts, periods, and vital coverage details for making informed decisions. Considering costs, policy comparisons, integration with other benefits, and selecting the right coverage based on individual needs are key aspects to explore further.

Introduction disability insurance

Disability insurance serves as an essential component in financial planning strategies, providing a safety net for individuals in the event of income loss due to illness or injury. This form of insurance guarantees that individuals can maintain financial security by replacing lost wages during periods of disability, thereby safeguarding against unforeseen circumstances. Understanding the fundamentals of disability insurance is vital for individuals seeking to protect their income and secure their financial future.

Brief overview of disability insurance

When considering financial protection against potential income loss due to illness or injury, disability insurance plays an indispensable role in safeguarding individuals’ financial security. Disability insurance, also known as income protection, provides coverage for individuals who are unable to work due to a disability. It replaces a portion of the individual’s lost wages during the benefit period, which can be short-term or long-term. Some policies may have exclusions for pre-existing conditions. This type of insurance can be offered by private insurers or government programs and is vital for maintaining financial stability in the event of a disability that prevents the individual from working.

Importance of disability insurance in financial planning

In financial planning, the inclusion of disability insurance is a vital and wise choice to ensure complete protection against potential income loss. When considering disability insurance as part of your financial protection plan, several benefits become apparent:

- Income Protection: Disability insurance serves as an income protection plan, ensuring that you continue to receive a portion of your income if you are unable to work due to a disability.

- Financial Security: It provides financial security during periods of disability, offering peace of mind knowing that your finances are safeguarded.

- Risk Management: Disability insurance is an essential component of risk management in financial planning, mitigating the impact of unforeseen events on your financial stability.

- Coverage Flexibility: Disability insurance can be tailored to meet your specific needs, offering different benefit amounts and coverage periods.

Understanding Disability Insurance

Disability insurance serves as an important financial tool designed to replace a portion of your income in case you become unable to work due to a disability. Understanding disability insurance involves grasping its definition and purpose, which is to provide financial security during periods of disability by replacing lost income. It is essential to comprehend the various aspects of disability insurance, such as benefit amount, benefit period, and elimination period, to make informed decisions about coverage.

Definition and Purpose

Disability insurance is a financial protection plan that replaces lost income in the event of total or partial disability due to illness or injury. It plays a crucial role in ensuring financial security for disabled individuals, employees, and their families by providing income replacement during periods of disability. Understanding what disability insurance is and how it functions is essential for individuals seeking to safeguard their financial well-being against unforeseen circumstances.

Explanation of what disability insurance is

An essential component of financial planning, disability insurance serves to safeguard individuals against income loss resulting from illness or injury.

- Provides income protection.

- Specifies benefit period.

- Defines occupational eligibility.

- Considers pre-existing conditions.

The role of disability insurance in income protection

In safeguarding against income loss due to illness or injury, disability insurance plays an essential role in providing financial protection for individuals. It offers income protection insurance by providing disability benefits during total disability. Policies may have pre-existing condition exclusions, and the benefit period specifies the duration of support. Understanding these aspects is important for individuals seeking thorough income protection through disability insurance.

Types of Disability Insurance

When considering disability insurance, individuals may encounter two primary types: Short-Term Disability Insurance and Long-Term Disability Insurance. These policies differ with respect to eligibility criteria and coverage options, catering to varying needs based on the duration of the disability. Understanding the distinctions between these types is vital for selecting the most suitable disability insurance plan.

Short-Term Disability Insurance

Short-term disability insurance provides coverage for a limited period, typically ranging from a few weeks to a few months, offering financial protection during short-term illnesses or injuries. Understanding the coverage details, the typical duration of benefits, and common scenarios for use is essential for individuals considering this type of disability insurance. By knowing these key points, individuals can make informed decisions to secure their financial well-being in case of temporary disability.

Coverage details

Short-term disability insurance provides temporary income protection for individuals who are unable to work due to illness or injury.

- Benefit Period: Typically ranges from a few weeks to a few months.

- Elimination Period: Waiting period before benefits begin.

- Occupation Definition: Determines eligibility based on the individual’s job role.

- Renewal Options: Options to extend or renew the policy after the initial term.

Typical duration of benefits

The typical duration of benefits for short-term disability insurance policies ranges from a few weeks to several months, providing temporary income protection for individuals unable to work due to illness or injury. Short-term disability policies often have a shorter benefit period compared to long-term disability insurance. The benefit period is the length of time benefits are payable, typically starting after an elimination period and based on the occupation definition in the policy.

Common scenarios for use

Following the typical duration of benefits, short-term disability insurance is designed to provide temporary income protection for individuals facing specific situations where they are unable to work.

- Partial disability coverage included.

- Helps replace lost wages.

- Can be used alongside accident insurance.

- Provides financial support in case of critical illness insurance.

Long-Term Disability Insurance

Long-Term Disability Insurance provides extensive coverage for extended periods, offering various benefit period options tailored to individual needs. Understanding the specific scenarios where long-term coverage is essential can help individuals make informed decisions about their financial security during times of disability. Exploring the coverage specifics and benefit period options is vital for selecting the most suitable long-term disability insurance plan.

Coverage specifics

Long-term disability insurance provides extended financial protection for individuals in the event of a disabling illness or injury.

- Benefit Amount: Determines the monthly payment received during disability.

- Elimination Period: The waiting period before benefits start.

- Occupation Definition: Specifies how disability impacts the insured’s ability to work in their occupation.

- Renewal Options: Details on renewing the policy after the initial term.

Benefit period options

When considering long-term disability insurance, one significant aspect to evaluate is the available benefit period options. The benefit period refers to the length of time during which the policy will pay out benefits in the event of total or partial disability. It is essential to understand how the policy defines total disability, partial disability, any pre-existing conditions exclusions, and how the occupation is defined for coverage purposes.

Scenarios where long-term coverage is essential

Ensuring financial stability in case of extended periods of disability is essential for individuals seeking extensive protection through long-term disability insurance.

- Income Protection: Long-term disability insurance provides income protection for an extended period.

- Financial Security: It offers financial security during prolonged disabilities.

- Benefit Period: The benefit period in long-term coverage is vital for sustained income replacement.

- Pre-existing Conditions: Some policies may have exclusions for pre-existing conditions.

Eligibility and Coverage

When considering disability insurance, understanding the general eligibility criteria is essential. This includes what disability insurance policies typically cover and any exclusions or limitations that may apply. These factors play a significant role in determining the level of financial protection provided in the event of disability.

General eligibility criteria for disability insurance

Eligibility for disability insurance is typically based on factors such as age, occupation, income level, and medical history.

- Age requirements may vary depending on the policy.

- Occupation can impact eligibility and coverage options.

- Income level determines the amount of income replacement.

- Pre-existing conditions may affect coverage terms and exclusions.

What disability insurance policies typically cover

Disability insurance policies typically cover a range of disabilities that can affect an individual’s ability to work and earn income. The table below summarizes key aspects of disability insurance coverage:

| Coverage | Description |

|---|---|

| Replaces income lost due to disability | Provides financial security during disability |

| Pre-existing condition exclusions | May have limitations based on prior conditions |

Exclusions and limitations

Exclusions and limitations are important aspects to take into account when evaluating the coverage provided by disability insurance policies.

- Pre-existing condition exclusions

- Benefit period

- Elimination period

- Occupation definition

These factors greatly impact the scope and duration of coverage, influencing the policy’s suitability for individual needs. Additionally, renewal options should be carefully considered to guarantee continued protection against unforeseen circumstances.

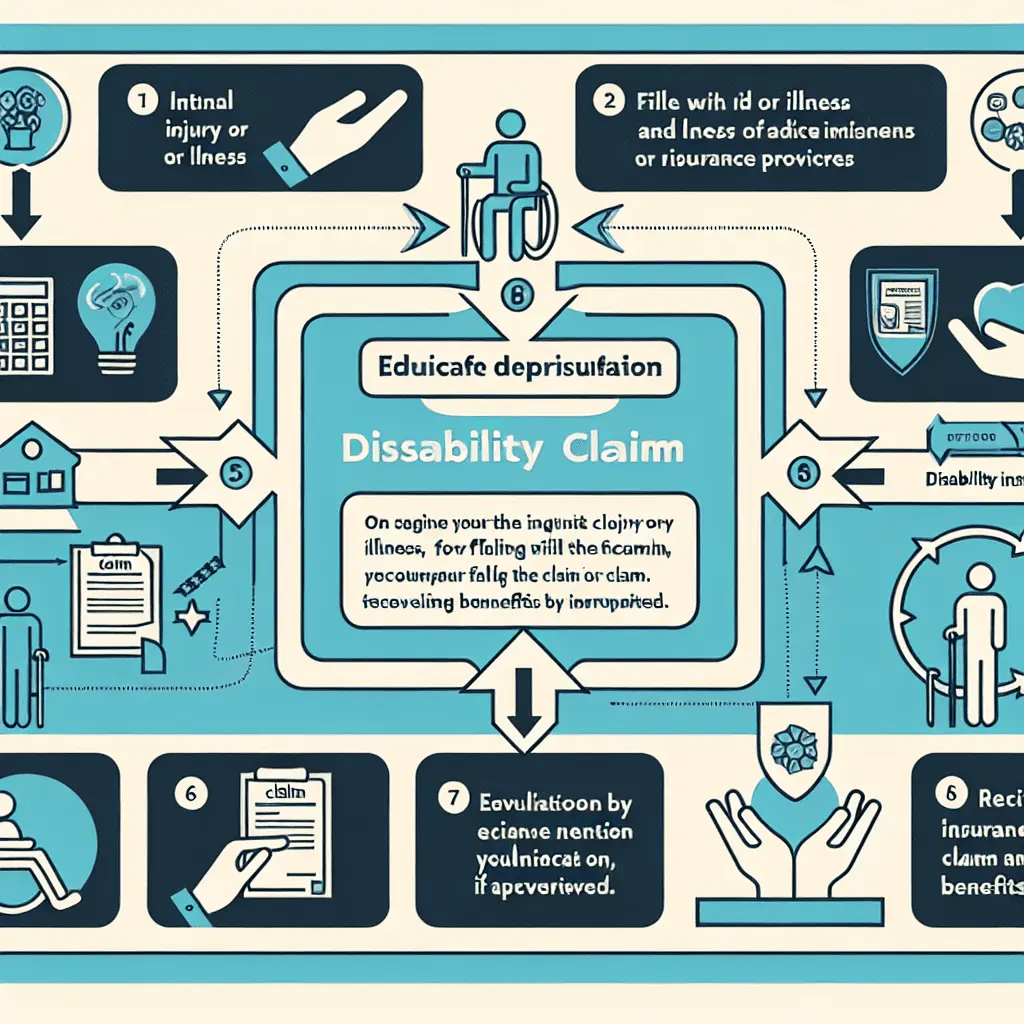

The Disability Insurance Claim Process

The Disability Insurance Claim Process involves filing a claim with the insurance company, where the individual must provide documentation to support their disability. The claim then undergoes a review process by the insurer, leading to either approval or denial based on the policy terms and the evidence presented. If approved, the individual may start receiving benefits, which will continue as long as the disability persists and meets the policy criteria.

Filing a Claim

Initiating the discussion on filing a disability insurance claim, it is essential to understand the step-by-step process required for submission. This involves gathering the necessary documentation and information to support the claim, as well as the pivotal role of medical professionals in validating the disability. The intricacies of the claim process highlight the importance of a systematic approach to guarantee a smooth and successful outcome.

Step-by-step guide on how to file a claim

When submitting a disability insurance claim, comprehending the process and adhering to specific steps is essential to guarantee a smooth and efficient experience.

- Contact your insurance company to initiate the claim.

- Complete the necessary claim forms accurately.

- Provide all required documentation to support your claim.

- Follow up with the insurance company regularly for updates on your claim status.

Required documentation and information

To facilitate the processing of a disability insurance claim, make sure that all relevant documentation and information are accurately provided. Required documentation may include medical records, proof of income, and details about the disability. Information about the benefit period and any pre-existing conditions should also be disclosed to guarantee a smooth claims process. Be thorough in submitting all necessary paperwork to prevent delays in receiving benefits.

The role of medical professionals in the claim process

The successful processing of a disability insurance claim heavily relies on the active involvement and input of medical professionals throughout the evaluation and verification stages.

- Medical professionals assess the claimant’s medical condition.

- They provide detailed reports and documentation.

- Their expertise helps determine the claimant’s eligibility.

- Medical professionals play an essential role in ensuring the accuracy and validity of the claim in a disability insurance context.

Claim Approval and Denial

In the disability insurance claim process, understanding how claims are evaluated, the reasons for approval or denial, and the steps to take if a claim is denied are vital aspects. The evaluation process involves appraising the individual’s medical records, supporting documentation, and adherence to policy terms. If a claim is denied, it is essential to review the denial reasons, gather additional evidence if needed, and consider appealing the decision through the insurer’s formal appeals process.

Understanding the evaluation process for claims

Understanding the evaluation process for claims is a critical aspect of maneuvering the Disability Insurance Claim Process, as it determines the approval or denial of claims for disability benefits. Key points to contemplate in the evaluation process include:

- Submission of complete claim documentation.

- Review of medical records and reports.

- Assessment of the claimant’s ability to work.

- Comparison of the claim against policy criteria for approval.

Reasons for claim approval or denial

Reasons for claim approval or denial in the Disability Insurance Claim Process are determined by a thorough evaluation of the submitted documentation, medical records, and the claimant’s ability to work against policy criteria. Factors such as meeting the benefit amount, elimination period, and occupation definition play an important role in the decision-making process. Claims may be denied if they do not meet these specific policy criteria, leading to a denial of benefits.

Steps to take if a claim is denied

Upon receiving a denial of a disability insurance claim, the initial step is to carefully review the denial letter for specific reasons and instructions on how to appeal the decision.

- Check the insurance policy for coverage details.

- Gather relevant medical records and documentation.

- Submit a formal appeal following the insurance company’s guidelines.

- Seek assistance from a legal professional specializing in disability insurance claims.

Continuing Benefits

Continuing Benefits in the disability insurance claim process involve the procedures for maintaining benefits while disabled, as well as the necessary reporting requirements and compliance measures. Understanding the process for continuing benefits is essential for individuals relying on disability insurance to guarantee they receive the financial support they are entitled to during their period of disability. Compliance with reporting requirements is vital to avoid any interruptions or denials in benefit payments.

Process for maintaining benefits during disability

When an individual becomes disabled and is in need of financial support, managing the process for maintaining benefits during disability can be an important step in ensuring continued financial security and stability.

- Understand the process for maintaining benefits during disability.

- Utilize the employee benefits package if offered by the employer.

- Engage with disability benefits administration and vocational rehabilitation services.

- Seek support from Employee Assistance Programs (EAP).

Reporting requirements and compliance

To guarantee the continuation of disability benefits, it is essential for claimants to follow the reporting requirements and adhere to the established guidelines throughout the disability insurance claim process. Compliance with these regulations ensures seamless income protection.

| Reporting Requirements | Compliance Guidelines | Social Safety Net Programs |

|---|---|---|

| Timely submission of documents | Honesty in reporting | Assistance with financial stability |

| Accurate information provision | Following medical recommendations | Support for disabled individuals |

| Updated medical records | Cooperation with insurance company | Government aid for income replacement |

Cost of Disability Insurance

When considering the cost of disability insurance, individuals must understand the various premium calculation factors that insurers use to determine the price of coverage. Comparing policies and providers is essential to make sure that the selected disability insurance plan aligns with the individual’s needs and budget. By evaluating these factors carefully, individuals can make informed decisions about securing financial protection in the event of disability.

Premium Calculation Factors

Premium calculation factors for disability insurance are vital in determining the cost of coverage. Factors such as age, occupation, and health status play a significant role in the premium calculation process. Understanding how these elements influence costs can help individuals make informed decisions when selecting a disability insurance policy.

How premiums are determined

The determination of disability insurance premiums is influenced by various factors that assess risk and financial protection needs. These factors include:

- Premium calculation: Utilizing mathematical models to determine appropriate premium amounts.

- Underwriting process: Evaluating applicant risk factors to set suitable premium rates.

- Health condition assessment: Reviewing the individual’s health status to gauge potential risks.

- Occupational risk evaluation: Analyzing the risks associated with the applicant’s occupation.

The impact of age, occupation, and health on costs

Factors like age, occupation, and health significantly influence the costs of disability insurance premiums. Younger individuals typically pay lower premiums due to reduced risk, while high-risk occupations might incur higher costs. Health conditions can also impact costs; those with pre-existing conditions may face higher premiums. Understanding these factors is essential in determining the cost of disability insurance coverage.

Examples of premium ranges for different scenarios

Examining various scenarios reveals the diverse premium ranges associated with disability insurance, shedding light on the nuanced factors influencing costs.

- Income Replacement Insurance: Premiums vary based on the percentage of income covered.

- Benefit Amount: Higher benefit amounts lead to higher premiums.

- Elimination Period: Shorter elimination periods result in higher premiums.

- Occupation Risk: Riskier occupations often have higher premium ranges.

Comparing Policies and Providers

When comparing disability insurance policies, it is essential to contemplate various factors such as coverage, benefit amounts, and elimination periods. Independent agents or brokers play a pivotal role in helping individuals navigate the complex landscape of disability insurance options and find the most suitable policy based on their specific needs. By leveraging the expertise of these professionals, individuals can make informed decisions that provide them with the necessary financial security in the event of a disability.

Tips for comparing disability insurance policies

In comparing disability insurance policies, one should carefully evaluate the coverage details, benefit amounts, and policy terms offered by different providers.

- Consider the income protection provided.

- Review the extent of disability coverage offered.

- Examine the benefit period duration.

- Check for any exclusions related to pre-existing conditions.

The importance of independent agents or brokers in the selection process

An integral aspect of evaluating disability insurance policies thoroughly is recognizing the value that independent agents or brokers bring to the selection process when comparing policies and providers. These professionals offer expertise, access to multiple insurers, personalized recommendations, and help in understanding policy details. Their role enhances the decision-making process, guaranteeing individuals secure the most suitable disability insurance coverage.

| Benefits of Independent Agents/Brokers | |

|---|---|

| Expertise in disability insurance policies | Access to multiple insurers |

| Personalized recommendations | Help in understanding policy details |

| Enhances decision-making process | Guarantees suitable coverage |

Integration with Other Benefits

When contemplating disability insurance, it is vital to understand how it integrates with other benefits such as those provided by the employer and Social Security Disability Insurance (SSDI). Coordination with these benefits can impact the overall coverage and financial support available during periods of disability. Understanding the interaction between disability insurance and these other benefits is essential for individuals seeking thorough protection in case of illness or injury.

Coordination with Employer-Provided Benefits

When considering disability insurance, understanding how it coordinates with employer-provided benefits is essential. This involves examining the interaction between disability coverage obtained through work and individual policies. Evaluating the advantages and disadvantages of group versus individual plans can help individuals make informed decisions about their financial protection.

How disability insurance works with employer-sponsored plans

Disability insurance can be effectively coordinated with employer-sponsored plans to provide extensive income protection for employees. When integrating disability insurance with employer-provided benefits, considerations include:

- Workers Compensation: Coordinating disability benefits with workers’ compensation.

- Employee Benefits Package: Ensuring disability coverage aligns with the overall benefits package.

- Disability Benefits Administration: Streamlining the administration of disability benefits within the organization.

- Social Security Disability Insurance (SSDI): Understanding how SSDI interacts with employer-sponsored disability plans.

The benefits and drawbacks of group vs. individual policies

Integrating disability insurance with employer-sponsored plans involves considering the benefits and drawbacks of group vs. individual policies to optimize income protection for employees.

| Aspects | Group Disability Insurance | Individual Disability Insurance |

|---|---|---|

| Cost | Lower premiums | Higher premiums |

| Coverage Customization | Limited customization options | Tailored to individual needs |

| Portability | Typically not portable | Portable between jobs |

| Underwriting Process | Simplified group underwriting | Individualized underwriting |

| Benefit Amount | Typically lower benefit amounts | Higher potential benefit amounts |

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance (SSDI) is a government program designed to provide financial assistance to individuals who are unable to work due to a disability. Understanding the relationship between SSDI and private disability insurance is essential for individuals seeking extensive coverage. While SSDI can be a valuable resource, it is important to recognize that relying solely on it may not offer enough protection, highlighting the need for additional private disability insurance coverage.

Overview of SSDI and its relationship with private disability insurance

Exploring the relationship between Social Security Disability Insurance (SSDI) and private disability insurance reveals essential insights into all-encompassing income protection planning.

- SSDI is a federal program providing benefits to individuals with disabilities.

- Private disability insurance supplements SSDI benefits.

- Coordination between SSDI and private disability insurance guarantees thorough coverage.

- Understanding the benefits and limitations of each type of insurance is essential for effective financial planning.

Eligibility criteria for SSDI

The eligibility criteria for Social Security Disability Insurance (SSDI) define the requirements for individuals to qualify for benefits under this federal program. Applicants must meet specific criteria related to work history, severity of disability, and inability to engage in substantial gainful activity. Pre-existing conditions may affect eligibility. Vocational rehabilitation may be offered to help individuals return to work if possible, impacting their eligibility for SSDI benefits.

Why SSDI should not be the sole disability coverage plan

Integrating Social Security Disability Insurance (SSDI) with other benefits is essential to guarantee thorough coverage and financial protection in the event of a disability. This integration avoids reliance solely on SSDI, ensuring adequate support. Reasons why SSDI should not be the sole disability coverage plan include:

- Limited income replacement from SSDI.

- Restrictions on pre-existing conditions.

- Varied coverage options from insurance companies.

- Supplemental disability benefits beyond SSDI.

Choosing the Right Disability Insurance

When selecting the appropriate disability insurance, it is essential to evaluate your specific needs thoroughly. Consider the policy riders and add-ons available to tailor the coverage to your requirements effectively. Understanding these aspects will help you make an informed decision about the right disability insurance policy for you.

Assessing Your Needs

When evaluating your disability insurance needs, it is essential to determine the appropriate coverage amount based on your occupation and income level. Considerations for specific occupations and income levels play a significant role in selecting the right disability insurance policy that will offer sufficient financial protection in case of disability. Tailoring your coverage to your specific circumstances guarantees you have the necessary support during challenging times.

How to determine the appropriate coverage amount

To determine the appropriate coverage amount for disability insurance, one must carefully assess their income, expenses, and financial obligations.

- Evaluate current income and expenses.

- Consider any existing disability coverage.

- Factor in potential benefits from other sources.

- Account for pre-existing conditions and their impact on coverage eligibility.

Considerations for specific occupations and income levels

Taking into account specific occupations and income levels is essential when choosing the appropriate disability insurance coverage to guarantee financial protection in case of unexpected disability. Factors such as occupational considerations, benefit amount, pre-existing condition exclusions, and occupation definition play an important role in determining the most suitable coverage for high income earners, ensuring thorough protection tailored to individual needs.

Policy Riders and Add-Ons

When choosing disability insurance, understanding policy riders and add-ons is essential. These additional features can offer customized benefits to meet specific needs and circumstances. Exploring common riders and their advantages allows individuals to personalize a policy that provides thorough protection.

Explanation of common riders and their benefits

Common riders and their benefits play a crucial role in enhancing the coverage and flexibility of disability insurance policies. These additional features offer tailored solutions to meet specific needs, providing added security and peace of mind. Some common riders include:

- Own-occupation coverage: Guarantees benefits are paid if unable to work in current occupation.

- Cost-of-living adjustment: Adjusts benefits based on inflation.

- Residual disability benefit: Provides partial benefits if partially disabled.

- Future purchase option: Allows increasing coverage without medical underwriting.

Customizing a policy to fit individual needs

To tailor disability insurance coverage to individual needs effectively, it is crucial to consider policy riders and add-ons that can enhance protection and address specific requirements. These additions can provide additional financial security, offer coverage for pre-existing condition exclusions, and guarantee that the policy aligns with the unique circumstances of the insured individual, enhancing the overall suitability and effectiveness of the disability insurance plan.

Frequently Asked Questions

Can Disability Insurance Cover Mental Health Conditions or Disabilities?

Yes, disability insurance can cover mental health conditions or disabilities. This type of insurance provides financial protection by replacing lost income in the event of a disability, whether physical or mental, that prevents the insured individual from working.

Are There Any Tax Implications for Receiving Disability Insurance Benefits?

Receiving disability insurance benefits may have tax implications depending on whether the premiums were paid with pre-tax or after-tax dollars. Benefits from employer-sponsored plans are generally taxable if the employer paid the premiums.

Can I Purchase Disability Insurance if I Am Self-Employed?

Managing self-employment complexities requires strategic financial planning. Evaluate disability insurance options that cater to self-employed individuals. Consider coverage benefits, potential limitations, and how it aligns with your risk management strategy for financial security.

How Does Disability Insurance Work for Gig Workers or Independent Contractors?

For gig workers or independent contractors, disability insurance provides income protection in case of illness or injury preventing work. It offers financial security by replacing lost wages, ensuring stability during periods of disability, and may vary in coverage options.

Is It Possible to Increase the Coverage Amount of Disability Insurance After the Policy Has Been Purchased?

Yes, it is possible to increase the coverage amount of insurance policies after purchase by requesting a policy review, completing a new application, and possibly undergoing additional underwriting. Contact your insurance provider for specific details.

Conclusion

To sum up, disability insurance plays a vital role in providing financial security during periods of disability, emphasizing the importance of safeguarding one’s income. It is advisable to consult with a professional to tailor a disability insurance plan that meets individual needs and circumstances, ensuring adequate coverage and peace of mind. Seeking expert advice can help navigate the complexities of disability insurance and make informed decisions about protecting against unforeseen challenges.

Recap of the importance of disability insurance

Disability insurance serves as an essential component of financial security by providing income protection in the event of disability. It is important to understand the significance of this type of coverage, considering factors like pre-existing conditions and benefit periods. Here is a brief recap highlighting the importance of disability insurance:

- Income Protection: Disability insurance replaces lost income during periods of disability.

- Financial Security: It provides a financial safety net to guarantee stability during challenging times.

- Pre-existing Conditions: Some policies may have exclusions related to pre-existing conditions.

- Disability Buyouts: This feature allows for a lump sum payment instead of ongoing benefits, offering flexibility to the insured individual.

Encouragement to seek professional advice for personalized coverage

Seeking guidance from a qualified insurance professional can help individuals tailor disability insurance coverage to their specific needs and circumstances. Professional advice guarantees that individuals receive adequate income protection and financial security in case of disability. Insurance professionals can provide insights into coverage options, including addressing concerns related to pre-existing conditions that may affect coverage eligibility. By consulting with a professional advisor, individuals can better understand the available coverage options, benefit periods, and potential exclusions. This personalized approach allows for a thorough assessment of the individual’s situation to determine the most suitable disability insurance coverage. To sum up, seeking professional advice is crucial to securing the right coverage that offers the necessary financial protection in times of need.