Ultimate Insurance List Find Your Perfect Coverage

As individuals endeavor to secure their financial stability and mitigate potential risks, the quest for the ideal insurance coverage becomes a vital aspect of their strategic planning. The concept of finding the perfect insurance solution tailored to one’s specific needs is a multifaceted journey that requires thorough consideration and informed decision-making. By exploring the depths of the ‘Ultimate Insurance List,’ readers can gain a detailed understanding of the diverse array of insurance options available. This guide not only sheds light on the fundamental principles of insurance but also empowers individuals to navigate the intricate world of insurance with confidence and precision.

Understanding Insurance Basics

Understanding the fundamental principles of insurance is paramount for individuals seeking to secure their financial well-being and mitigate risks effectively in various aspects of their lives. Insurance serves as an important tool in risk management, providing a safety net against unforeseen events. In this system, the insurer, typically an insurance company, offers financial protection to the insured or policyholder. To obtain this coverage, the insured pays a premium to the insurer, who then undertakes the responsibility of covering potential losses as outlined in the policy terms.

One of the critical functions of insurance companies is underwriting, where they assess the risk associated with insuring an individual or entity. This process helps determine the premium amount and policy conditions. Claims processing is another essential aspect wherein the insured party can file a claim in the event of a covered loss. The insurer then evaluates the claim and processes it according to the policy terms and conditions.

Essentially, insurance operates on the foundation of managing risks through financial protection mechanisms. By understanding the roles of the insurer and insured, the significance of premiums, underwriting procedures, claims processing, and policy terms, individuals can navigate the complex world of insurance with more confidence and make informed decisions to safeguard their assets and well-being.

Personal Insurance Options

Exploring the diverse array of personal insurance options available can empower individuals to make informed decisions to protect their financial well-being and assets effectively. Health insurance plays a vital role in covering medical expenses and ensuring access to quality healthcare. Life insurance provides financial security to loved ones in the event of the policyholder’s death, with options such as term life insurance for temporary coverage or whole life insurance for lifelong protection. Homeowners insurance safeguards one’s property against damages and liabilities, offering peace of mind to homeowners. Auto insurance is essential for protecting vehicles and providing liability coverage in case of accidents. Disability insurance offers income protection in the event of a disability that prevents one from working.

Long-term care insurance is designed to cover the costs associated with long-term care services, offering financial relief to policyholders. Travel insurance provides coverage for unexpected events during trips, such as trip cancellations or medical emergencies abroad. Additionally, pet insurance helps cover veterinary expenses for beloved furry companions, ensuring their well-being without financial strain. Understanding the nuances of each type of personal insurance allows individuals to tailor their coverage to meet their specific needs and mitigate potential risks effectively.

Health Insurance Types

To explore further into the domain of personal insurance options, a thorough understanding of the different types of health insurance available is essential. Health insurance plays a significant role in safeguarding individuals against high medical costs and securing access to necessary healthcare services. When contemplating health insurance, it is important to be aware of the various types and coverage options available. Here are some key points to ponder:

- Types of Health Insurance: Understanding the distinctions between HMOs, PPOs, EPOs, and POS plans can help determine which suits your needs best.

- Premium Rates: Consider the monthly costs of the insurance plan along with any copayments, coinsurance, or deductibles that may apply.

- Policy Benefits: Assess the extent of coverage provided, including services such as hospital stays, doctor visits, and emergency care.

- Network Providers: Check whether your preferred healthcare providers are included in the plan’s network to guarantee continuity of care.

- Prescription Coverage and Preventive Care: Evaluate how prescription medications and preventive services like vaccinations are covered under the policy to maintain overall health and well-being.

Life Insurance Considerations

Life insurance plays an essential role in providing financial protection for individuals and their loved ones in the event of unexpected circumstances. When considering life insurance options, individuals often encounter the choice between term life insurance and whole life insurance. Term life insurance provides coverage for a specified term, offering a death benefit to beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire life of the policyholder and includes a cash value component that can grow over time.

Several factors should be considered when selecting a life insurance policy. These factors include the premium payment amount, coverage terms, beneficiary designations, and policyholder information. Premium payments are important as they determine the cost of the policy and its sustainability over time. Understanding the coverage terms is important to make sure that the policy meets the individual’s needs for financial security. Additionally, selecting appropriate beneficiary designations guarantees that the intended recipients receive the death benefit as intended.

Ultimately, choosing the right life insurance policy involves a careful evaluation of these factors to make sure that the policy provides the necessary protection and peace of mind for the policyholder and their loved ones.

Disability Insurance Essentials

When considering the importance of financial protection in unforeseen circumstances, understanding the essentials of disability insurance becomes paramount.

- Income Protection: Disability insurance provides a source of income if you are unable to work due to a disability.

- Disability Coverage: Different policies offer varying degrees of coverage for disabilities, whether short-term or long-term.

- Benefits: Policyholders receive benefits to replace a portion of their income if they become disabled and are unable to work.

- Premiums: The cost of disability insurance, known as premiums, can vary based on factors such as age, health, and occupation.

- Occupational Coverage: Some disability insurance policies offer coverage tailored to specific occupations, ensuring protection that aligns with your job requirements.

Understanding the terms specific to disability insurance is vital. The elimination period refers to the waiting period before benefits kick in after becoming disabled. Additionally, policies may cover partial disability, providing benefits if you can work, but not at full capacity. By grasping these fundamental aspects of disability insurance, individuals can make informed decisions to safeguard their financial well-being in times of need.

Homeowners Insurance Coverage

Providing essential protection for one of life’s most significant investments, homeowners insurance coverage safeguards against a range of potential risks and liabilities faced by property owners. Homeowners insurance typically includes two primary components: dwelling coverage and liability protection. Dwelling coverage insures the physical structure of the home against perils like fire, vandalism, and natural disasters. It’s important for homeowners to understand their policy limits, which determine the maximum amount the insurance company will pay out for a covered loss. Exclusions are specific situations or types of damage not covered by the policy, so reviewing these carefully is vital.

In addition to protecting the physical structure, homeowners insurance also provides liability protection. This coverage can help pay for legal fees and medical expenses if someone is injured on the property. Homeowners should consider their coverage level carefully to make they have adequate protection in the event of a liability claim.

When selecting homeowners insurance, individuals may have options for deductible amounts, which is the out-of-pocket cost the homeowner must pay before the insurance coverage kicks in. Understanding the claims process is important, as it outlines the steps to take when filing a claim and the documentation required for a smooth experience. By evaluating deductible options, coverage levels, and familiarizing themselves with the policy details, homeowners can make informed decisions to protect their valuable investment.

Auto Insurance Explained

Homeowners insurance provides essential protection for property owners, safeguarding against various risks and liabilities, but shifting focus to auto insurance, it is important to understand the intricacies of coverage and benefits. Auto insurance, also known as car insurance, is a vital financial product that provides protection for drivers in case of accidents or other vehicle-related incidents. Here are some key points to contemplate when delving into the world of auto insurance:

- Liability Insurance: Covers costs associated with bodily injury or property damage to others in an accident you are found responsible for.

- Coverage Limits: The maximum amount your insurer will pay for covered losses.

- Deductible: The amount you are responsible for paying before your insurance coverage kicks in.

- Claim: A request made by you to your insurance company to cover a loss.

- Agent/Broker: Professionals who can help you navigate the complexities of auto insurance policies.

Understanding the policy term, which is the duration for which your policy is in effect, is essential. Brokers or agents can assist in finding the right coverage for your needs. It’s vital to review and understand your policy to make certain you have adequate protection in place.

Business Insurance Overview

An essential aspect of safeguarding business assets and operations is ensuring thorough protection through a well-structured business insurance policy. Commercial insurance plays a vital role in shielding businesses from various risks they may encounter. Here is a breakdown of key types of business insurance:

| Type of Insurance | Description |

|---|---|

| Property and Casualty Insurance | Protects physical assets like buildings, equipment, and inventory from damage or loss. |

| Business Interruption Insurance | Covers lost income and ongoing expenses if a business is unable to operate due to a covered peril. |

| Product Liability Insurance | Shields businesses from financial losses due to defective products causing harm to consumers. |

| Professional Indemnity Insurance | Provides protection against claims of professional negligence resulting in financial loss to a client. |

| Commercial Auto Insurance | Covers vehicles used for business purposes against damage and liability risks. |

| Cyber Liability Insurance | Protects against cyber threats and data breaches that could compromise sensitive information. |

Regulatory oversight ensures that businesses adhere to legal requirements concerning insurance coverage. Understanding the nuances of each type of insurance and tailoring them to the specific needs of the business is crucial for comprehensive coverage. By carefully selecting and combining different policies, businesses can create a robust safety net against unforeseen circumstances.

Choosing the Right Policy

After understanding the key types of business insurance that safeguard businesses from various risks, the next important step is to carefully evaluate and select the most important policy to guarantee thorough protection. When choosing the right insurance policy, there are several vital factors to examine****:

- Protection: Confirm the policy provides detailed coverage for your specific business needs.

- Premiums: Understand the cost of premiums and how they fit into your budget while taking into account the level of coverage offered.

- Deductibles: Evaluate the deductibles you will be responsible for in the event of a claim and choose a level that aligns with your financial capabilities.

- Exclusions: Pay close attention to what the policy excludes from coverage to avoid any surprises during a claim.

- Underwriting: Familiarize yourself with the underwriting process to understand how the insurance company assesses your risk profile.

Carefully reviewing the policy terms, including coverage details, premiums, deductibles, and exclusions, is essential to ensure you have the right level of safeguard. Additionally, understanding the claims process and how claims are handled under the policy can help you make an informed decision. By taking into account these factors and conducting a thorough evaluation, you can select a business insurance policy that provides the necessary coverage for your enterprise.

Comparing Insurance Quotes

Comparing Insurance Quotes

When evaluating insurance options, it is important to compare quotes from different providers to make sure you are getting the best coverage at the most competitive rates. Utilizing online platforms and comparison tools can streamline this process by allowing you to input your information once and receive multiple quotes to compare side by side. When comparing insurance quotes, pay close attention to premium rates, coverage options, policy terms, and deductible amounts.

Premium rates are the amount you pay for the insurance policy, typically on a monthly or annual basis. Confirm that you are comparing similar coverage levels when looking at premium rates to make an accurate comparison. Coverage options refer to what is included in the policy, such as liability limits, additional riders, or specific coverage for certain events. Policy terms outline the duration of coverage and any specific conditions or limitations that apply. Deductible amounts are the out-of-pocket expenses you must pay before the insurance coverage kicks in.

To get the best deal, consider using negotiation strategies such as asking for discounts, bundling policies, or adjusting coverage levels to meet your needs while potentially reducing costs. By carefully comparing insurance quotes and understanding the details of each policy, you can make an informed decision that provides the coverage you need at a price you can afford.

Negotiating Premium Rates

Moving from the comparison of insurance quotes to the aspect of negotiating premium rates requires a strategic approach to guarantee maximum coverage that aligns with your financial objectives. When negotiating premium rates for your insurance policy, consider the following:

- Understand Policy Terms: Familiarize yourself with the specifics of the insurance policy, including coverage limits, exclusions, and conditions.

- Evaluate Risk Tolerance: Determine the level of risk you are willing to bear and adjust your premium rates accordingly.

- Review Deductible Amount: A higher deductible usually results in lower premiums, so assess what deductible amount aligns best with your financial situation.

- Engage in Negotiation: Don’t hesitate to negotiate with the insurance provider to secure competitive premium rates.

- Review Coverage Needs: Regularly review your coverage needs to make certain that you are not overinsured or underinsured based on your current circumstances.

Negotiating premium rates is a important aspect of obtaining the right insurance coverage that meets your needs while also being financially sustainable. By understanding the policy terms, evaluating your risk tolerance, reviewing deductible amounts, actively negotiating, and regularly reviewing your coverage needs, you can optimize your insurance policy to provide effective coverage at a reasonable cost.

Making an Insurance Claim

Initiating an insurance claim requires adherence to specific procedures and documentation to guarantee a smooth and efficient process. When faced with a situation that necessitates filing an insurance claim, it is important to understand the claim process outlined in your policy. This typically involves notifying your insurance company promptly, providing detailed information about the incident, and submitting the necessary documentation to support your claim. Documentation plays an important role in the success of your insurance claim. This may include police reports, photographs of the damage or incident, medical records, receipts for expenses incurred, and any other relevant proof required by your insurer.

To ensure a smooth experience during the claims process, it is essential to familiarize yourself with your policy terms and exclusions. Understanding what is covered and any potential limitations can help manage expectations and avoid surprises when negotiating the settlement. Exclusions in your policy may outline specific circumstances or types of damage that are not covered, highlighting the importance of reviewing your policy thoroughly. By following the prescribed procedures, providing accurate documentation, and being aware of your policy’s terms and exclusions, you can navigate the insurance claim process effectively and work towards a fair resolution.

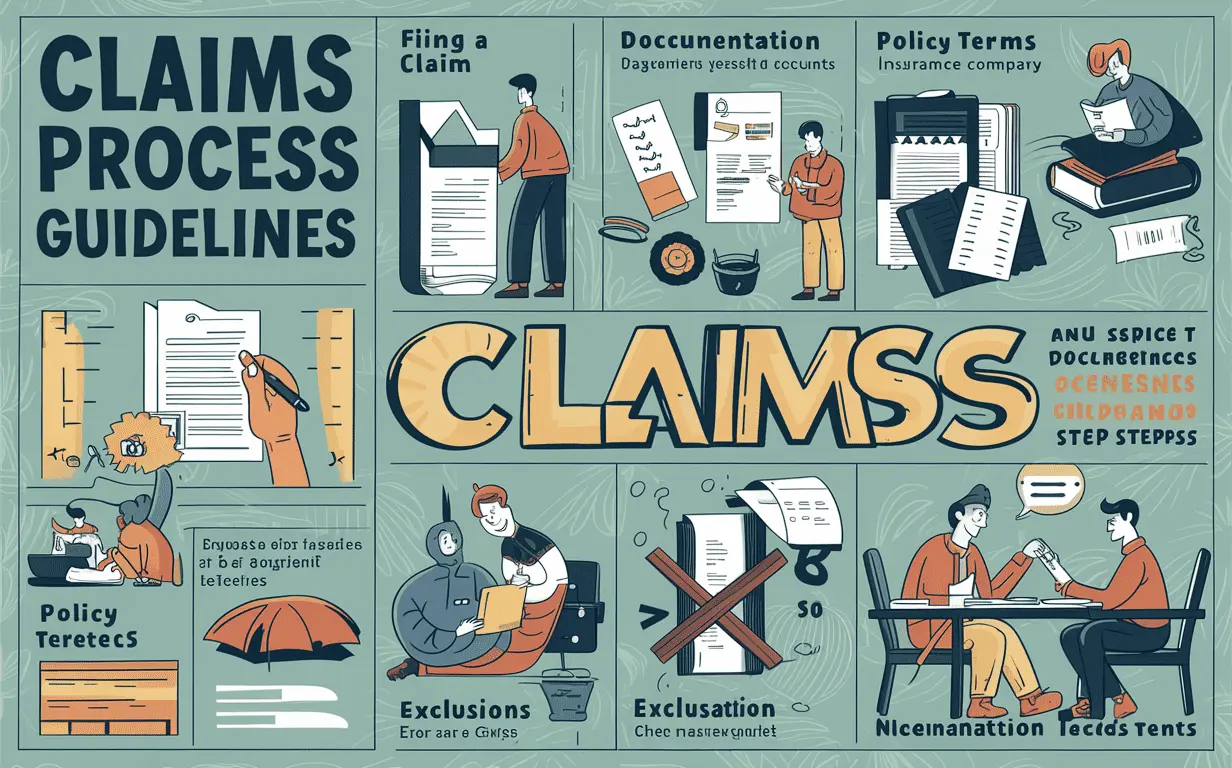

Claims Process Guidelines

Understanding the guidelines for the claims process is essential for a successful resolution and efficient handling of insurance claims. When filing a claim with your insurance provider, it is vital to adhere to specific procedures and requirements to guarantee a smooth experience. Here are some key points to keep in mind:

- Filing a Claim: Initiate the claims process promptly after an incident or loss occurs.

- Documentation: Prepare and submit all necessary documents such as proof of loss, receipts, and any other relevant information.

- Policy Terms: Familiarize yourself with your insurance policy terms to comprehend what is covered under your plan.

- Exclusions: Be aware of any exclusions in your policy that may impact the claim settlement.

- Negotiation: In case of disputes or disagreements with the insurance provider, be prepared to bargain for a fair resolution.

Managing Multiple Policies

Effective management of multiple insurance policies requires a thorough understanding of each policy’s coverage, terms, and conditions to guarantee all-encompassing protection and avoid potential gaps in coverage. When dealing with multiple policies from different insurance providers, it is essential to assess your coverage needs meticulously. By evaluating your requirements for each type of insurance, such as health, auto, home, and life, you can tailor your policies to provide all-encompassing protection while eliminating redundancies.

One strategy to streamline the management of multiple policies is to explore bundling options offered by insurance companies. Bundling allows you to combine various insurance policies, such as auto and home insurance, with a single insurer. This not only simplifies the administrative process but can also lead to cost savings through discounted premiums.

Understanding the policy terms and exclusions of each insurance policy is critical to ensure you are adequately protected in various scenarios. Pay close attention to the details of each policy, including coverage limits, deductibles, and any specific exclusions that may apply. Furthermore, negotiating premiums with your insurance providers can help you secure competitive rates while maintaining the desired level of coverage across your multiple policies. By actively managing your policies and staying informed about your coverage, you can effectively navigate the complexities of managing multiple insurance policies.

Maintaining a Good Credit Score

To secure a thorough approach to managing multiple insurance policies, it is important to recognize the significant impact that maintaining a good credit score can have on your ability to secure favorable insurance rates and coverage options. Your credit score plays a vital role in determining the insurance premiums you pay and the policy terms available to you. Here are five key points highlighting the importance of maintaining a good credit score for your insurance needs:

- Financial Protection: A good credit score can lead to lower insurance premiums, saving you money in the long run.

- Risk Management: Insurance companies view individuals with higher credit scores as lower risks, potentially resulting in better coverage options.

- Negotiation Advantage: When negotiating insurance rates, a good credit score can give you leverage to secure more favorable terms.

- Coverage Needs: Maintaining a good credit score enables you to access a wider range of coverage options tailored to your specific needs.

- Competitive Rates: With a good credit score, you are more likely to qualify for competitive insurance rates, ensuring cost-effective coverage for your assets and liabilities.

Frequently Asked Questions

What Are the Key Factors That Influence Insurance Premiums and How Can Policyholders Potentially Lower Their Rates?

Key factors influencing insurance premiums include risk assessment, coverage limits, deductible amounts, and policyholder’s history. To potentially lower rates, policyholders can improve credit scores, bundle policies, adjust coverage levels, and maintain a clean claims record.

How Do Insurance Companies Determine the Value of Personal Belongings for Homeowners Insurance Coverage?

Insurance companies determine the value of personal belongings for homeowners insurance coverage through assessments, appraisals, and documentation provided by policyholders. Factors such as replacement cost, depreciation, and policy limits are considered to accurately reflect the value of insured items.

Are There Any Specific Types of Businesses or Industries That May Require Specialized Insurance Coverage Beyond Standard Business Policies?

Certain industries like healthcare, construction, and transportation require specialized insurance coverage beyond standard policies. Malpractice insurance for healthcare, contractor’s liability for construction, and cargo insurance for transportation are examples. Tailored coverage mitigates industry-specific risks effectively.

How Does the Claims Process Differ for Different Types of Insurance Policies, Such as Health Insurance Versus Auto Insurance?

The claims process varies between insurance policies like health and auto insurance. Health insurance often requires pre-authorization for medical services, while auto insurance involves reporting accidents and damage. Understanding policy-specific procedures is essential for successful claims.

What Are Some Potential Consequences of Not Reviewing and Updating Insurance Coverage Regularly, Especially in the Event of Major Life Changes or Developments?

Failure to review and update insurance coverage regularly can lead to gaps in protection, inadequate coverage for new risks, or overpaying for unnecessary policies. Major life changes like marriage, birth, or career shifts necessitate policy adjustments for best protection.