Introduction car insurance in Florida

Car insurance in Florida is a legal requirement for vehicle owners to protect themselves and others in case of accidents.

Understanding the factors that influence car insurance rates, such as driving record, age, and vehicle type, can help individuals make informed decisions when selecting coverage.

Being aware of the basics of car insurance in Florida can assist drivers in finding the most suitable and affordable options for their needs.

Brief overview of car insurance in Florida

Florida’s car insurance landscape presents a variety of options for drivers seeking coverage for their vehicles. When looking for car insurance in Florida, drivers have the opportunity to explore different car insurance companies in Florida offering varying rates.

The state’s car insurance rates Florida can fluctuate based on several factors, making it essential for drivers to shop around for inexpensive car insurance Florida. By comparing quotes and coverage options, drivers can find the cheapest car insurance Florida that meets their needs.

Understanding the different aspects of car insurance in Florida, such as coverage requirements and available discounts, can help drivers make informed decisions when selecting a policy.

Importance of understanding car insurance rates and factors influencing them

Understanding the factors that influence car insurance rates is essential for drivers in Florida to make informed decisions when selecting a policy. Several key elements affect car insurance rates in Florida, including:

- the driver’s age,

- driving record,

- location,

- type of vehicle,

- coverage limits, and

- credit score.

Factors such as the frequency of accidents and thefts in the area can also impact Florida car insurance premiums.

By comprehending these factors and how they influence car insurance costs, drivers can better assess their insurance needs and find suitable coverage at competitive rates.

Additionally, being aware of available car insurance discounts in Florida, such as for safe driving habits or bundling policies, can help drivers save money while maintaining adequate insurance protection.

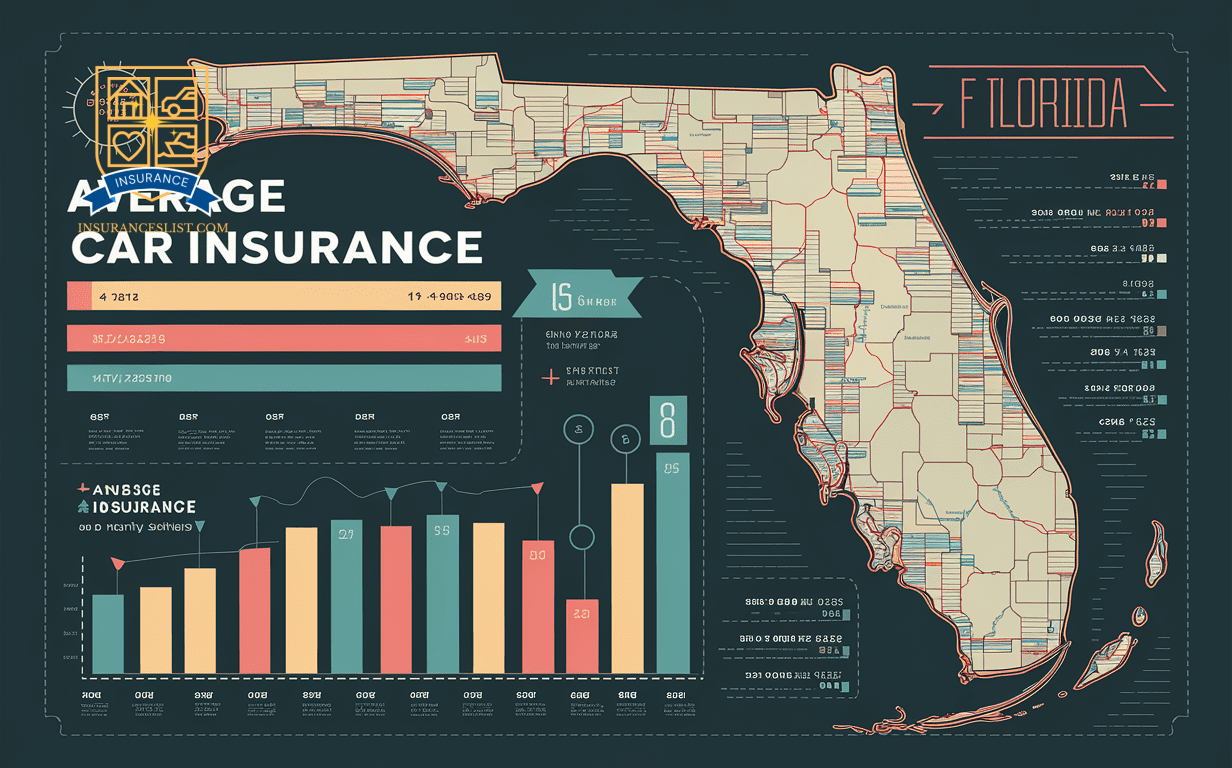

Average Car Insurance Costs in Florida

When considering the average car insurance costs in Florida, it is important to look at different types of coverage such as full coverage and minimum coverage insurance. Additionally, exploring the variations in the cheapest car insurance rates across cities like Miami, Orlando, Jacksonville, and Tampa can provide valuable insights for drivers in Florida.

Understanding the differences in insurance costs in areas like Fort Lauderdale, Pensacola, Brandon, and Clermont can help individuals make informed decisions about their car insurance needs.

Full coverage insurance

When considering full coverage insurance in Florida, key points to explore include the average cost for a driver with good credit and the least expensive companies offering full coverage options.

Understanding these factors can help drivers make informed decisions when selecting the most cost-effective and thorough insurance for their vehicles in the state of Florida.

Average cost for a driver with good credit

The average cost for full coverage insurance in Florida for a driver with good credit can vary depending on several factors.

Driving history plays a significant role.

The type of vehicle being insured is also a key factor.

Discounts offered by insurance companies can affect the overall cost.

Cheapest companies for full coverage insurance

Considering the varying factors that impact insurance costs, identifying the cheapest companies for full coverage insurance in Florida is essential for drivers seeking affordable options.

When looking for the best full coverage car insurance in Florida, considering car insurance companies in Florida that offer inexpensive car insurance rates can help save money.

Comparing quotes and policies can lead to finding the most cost-effective and beneficial coverage.

Minimum coverage insurance

When considering minimum coverage insurance in Florida, it is essential to understand the average cost for a driver with good credit.

Additionally, knowing the cheapest companies for minimum coverage insurance can help individuals make informed decisions about their car insurance.

Exploring these points will provide valuable insights into securing affordable insurance options in Florida.

Average cost for a driver with good credit

On average, a driver with good credit can expect to pay a moderate premium for minimum coverage car insurance in Florida.

- Good credit score can lead to lower premiums.

- Some insurance companies offer discounts for good credit.

- Cost-saving tips like bundling policies can further reduce expenses.

Cheapest companies for minimum coverage insurance

Amid the multitude of options available, discerning the most cost-effective companies for minimum coverage insurance in Florida requires a careful evaluation of both rates and coverage benefits.

When seeking cheap car insurance in Florida, consider companies that offer low-cost options while still providing adequate protection.

Look for the most affordable car insurance in Florida that balances affordability with necessary coverage, ensuring you meet the state’s insurance requirements effectively.

Cheapest car insurance in Miami, Orlando, Jacksonville, Tampa, Fort Lauderdale, West Palm Beach, Pensacola, Brandon, Clermont, Largo,Key West – Florida(FL), US

In the world of car insurance options in Florida, seeking the most cost-effective coverage is a prudent financial choice for residents of Miami, Orlando, Jacksonville, Tampa, Fort Lauderdale, West Palm Beach, Pensacola, Brandon, Clermont, Largo, and Key West.

When looking for the cheapest car insurance in these cities, consider the following:

- Compare car insurance quotes from multiple providers in Florida.

- Explore the offerings of different Florida car insurance companies.

- Look for discounts and incentives that can help secure Florida cheap car insurance rates.

Best car insurance in Fort Myers, Naples, Kissimmee, Saint Petersburg, Ocala, Sarasota, Tallahassee, Lakeland,Daytona Beach, Homestead – Florida(FL), US

Exploring the top-rated car insurance options in Fort Myers, Naples, Kissimmee, Saint Petersburg, Ocala, Sarasota, Tallahassee, Lakeland, Daytona Beach, and Homestead, Florida, provides valuable insights into average insurance costs in the state.

When seeking the best car insurance in these areas, it’s essential to compare car insurance quotes in Florida to find the most suitable coverage for your needs. Florida car insurance rates can vary based on factors such as location, driving history, and the type of coverage required.

Cheapest car insurance in Bradenton, Melbourne, Gainesville, Hialeah, Boca Raton, Clearwater, Panama City, Vero Beach,Winter Haven, Fort Pierce – Florida(FL), US

Comparing auto insurance options in Bradenton, Melbourne, Gainesville, Hialeah, Boca Raton, Clearwater, Panama City, Vero Beach, Winter Haven, and Fort Pierce, Florida, can reveal the most affordable car insurance rates available in the state.

When looking for the cheapest car insurance in Florida, it’s essential to obtain quotes from various providers to find the most cost-effective option. Factors such as the driver’s age, driving record, and type of coverage required can impact the final premium. Additionally, taking advantage of discounts offered by insurance companies can help lower the overall cost of car insurance in Florida.

- Obtain quotes from multiple insurance providers

- Consider personal factors that affect insurance rates

- Explore available discounts to reduce costs

Best car insurance in Cape Coral, Hollywood, Port Saint Lucie, New Port Richey, Panama City Beach, Saint Augustine,Delray Beach, Palm Coast, Jupiter – Florida(FL), US

When evaluating the best car insurance options in Cape Coral, Hollywood, Port Saint Lucie, New Port Richey, Panama City Beach, Saint Augustine, Delray Beach, Palm Coast, and Jupiter in Florida, it is important to take into account the average car insurance costs in the state. Below is a comparison table showcasing the average annual car insurance rates in these cities:

| City | Average Annual Car Insurance Cost |

|---|---|

| Cape Coral | $1,345 |

| Hollywood | $1,548 |

| Port Saint Lucie | $1,421 |

| New Port Richey | $1,386 |

| Panama City Beach | $1,399 |

| Saint Augustine | $1,367 |

| Delray Beach | $1,488 |

| Palm Coast | $1,402 |

| Jupiter | $1,479 |

Comparing these average costs can help individuals make an informed decision when selecting the best car insurance in these Florida cities.

Cheapest car insurance in Destin, Stuart, Port Charlotte, Pompano Beach, Fort Walton Beach, Venice, Spring Hill, Boynton Beach, The Villages, Lake Worth – Florida(FL), US

In the context of evaluating car insurance options in Florida, particularly in Destin, Stuart, Port Charlotte, Pompano Beach, Fort Walton Beach, Venice, Spring Hill, Boynton Beach, The Villages, and Lake Worth, understanding the average car insurance costs in these areas is paramount.

Factors influencing car insurance rates include driving record, age, and the type of coverage chosen.

Researching and comparing quotes from multiple insurance providers can help find the most affordable option.

Taking advantage of discounts, such as safe driver or bundled policies, can lead to further cost savings.

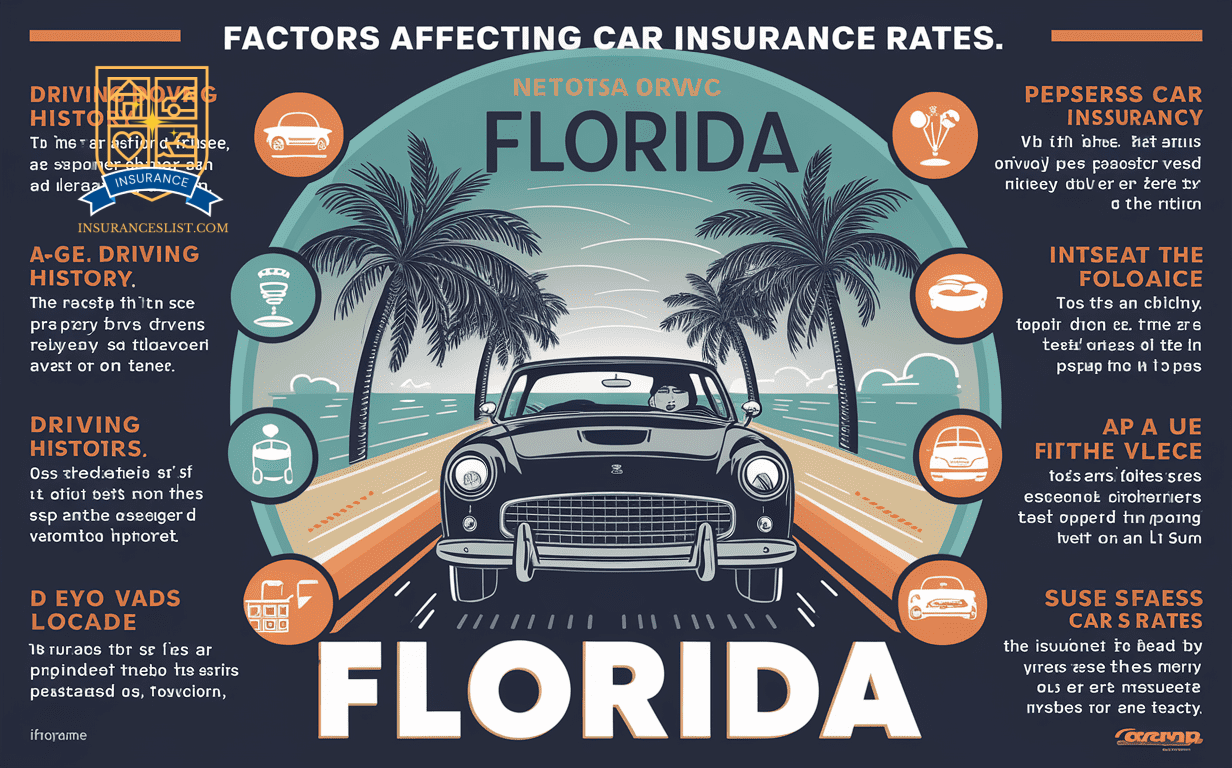

Factors Influencing Car Insurance Rates in Florida

When determining car insurance rates in Florida, several key factors come into play. These include:

- An individual’s driving history

- Credit score

- Age

- Location

- The level of coverage they choose

Each of these elements can greatly impact the cost of car insurance in the state, making it essential for drivers to understand how these factors influence their rates.

Driving history

A driver’s history plays a significant role in determining car insurance rates in Florida. Factors such as at-fault accidents, traffic violations, incident frequency, recency, and driving experience all impact the cost of insurance premiums.

Insurance companies assess these points to evaluate the level of risk associated with insuring a particular driver.

At-fault accidents

Driving history plays a significant role in determining car insurance rates in Florida, particularly in cases of at-fault accidents.

- At-fault accidents can lead to higher insurance premiums.

- Multiple at-fault accidents may result in further rate increases.

- Some insurance companies offer accident forgiveness programs for the first at-fault incident.

Traffic violations

Traffic violations can greatly impact car insurance rates in Florida, reflecting a driver’s risk profile and potentially leading to higher premiums. Below is a table illustrating how different traffic violations can affect car insurance rates in Florida:

| Traffic Violation | Impact on Insurance Rates |

|---|---|

| Speeding Ticket | Increased Rates |

| DUI | Significant Increase |

| Reckless Driving | High Premiums |

| Running a Red Light | Elevated Costs |

| At-Fault Accident | Rate Spike |

Incident frequency and recency

Frequency and recency of incidents behind the wheel play a significant role in determining car insurance rates in Florida.

- High incident frequency leads to higher premiums.

- Recent accidents or violations can result in increased rates.

- Car insurance companies in Florida consider both the number and timing of incidents to assess risk accurately, impacting the cost of coverage.

Driving experience

An individual’s historical record behind the wheel greatly influences the determination of car insurance rates in Florida. Driving experience is a key factor considered by insurance companies when evaluating risk levels.

Those with a clean driving history are more likely to qualify for the best car insurance in Florida and secure the most affordable car insurance in the state.

Maintaining a good driving record can lead to better rates on vehicle coverage and car policy.

Credit score

Credit score plays a significant role in determining car insurance rates in Florida.

Various components of a credit score, such as payment history, credit utilization, and credit history length, can impact insurance premiums.

Understanding how these elements affect insurance rates can help individuals make informed decisions to potentially lower their car insurance costs in Florida.

Role of credit score in determining car insurance rates

Considering the impact of credit scores on car insurance rates in Florida reveals an essential aspect of determining policy costs.

- Financial history plays a significant role in evaluating creditworthiness for insurance purposes.

- A higher credit score can lead to lower insurance premiums.

- Poor credit may result in higher car insurance rates due to perceived risk factors.

Components of credit score and their impact on insurance rates

The correlation between specific components of an individual’s credit score and the resulting impact on car insurance rates in Florida is a crucial factor in determining policy costs. Factors such as payment history, credit utilization, length of credit history, new credit accounts, and credit mix all play a role in shaping insurance rates.

Insurers take into account these components when evaluating risk and setting premiums for policyholders in Florida.

Age

Age is a significant factor in determining car insurance rates in Florida. Insurers consider age as a predictor of risk, with younger drivers typically facing higher premiums due to their perceived higher likelihood of being involved in accidents.

Understanding how age affects car insurance costs can help individuals make informed decisions when seeking the most affordable coverage.

How age affects car insurance rates

Factors such as the driver’s age play a significant role in determining car insurance rates in Florida.

Younger drivers typically face higher premiums due to perceived higher risk.

Older drivers may benefit from lower rates as they are seen as more experienced.

Some car insurance companies in Florida offer discounts to drivers over a certain age.

Average car insurance costs by age

Younger and older drivers in Florida experience different car insurance costs based on their age, highlighting the substantial impact age has on insurance rates.

Average car insurance costs by age can vary greatly, affecting overall car insurance rates in Florida.

Understanding how much car insurance in Florida can cost based on age can help individuals find the cheapest car insurance from various car insurance companies in the state.

Location

The location where a driver resides plays a significant role in determining car insurance rates in Florida. Factors such as population density, crime rates, and weather conditions can contribute to higher insurance premiums in certain areas of the state.

Understanding how location influences insurance costs is essential for Florida drivers looking to secure the most affordable coverage.

Impact of location on car insurance rates

One significant aspect that directly influences car insurance rates in Florida is the geographical location where the vehicle is primarily operated.

- Urban areas tend to have higher rates due to increased traffic and crime.

- Coastal regions may face higher premiums due to the risk of hurricanes and flooding.

- Rural areas generally have lower rates as they pose fewer risks for insurers.

Factors contributing to higher rates in Florida

Geographical location plays a significant role in determining car insurance rates in Florida. Various factors contribute to higher premiums in different areas. Factors affecting car insurance rates include Florida car insurance costs, the impact of driving records on insurance rates, and Florida insurance regulations.

Understanding these elements is essential when seeking the most affordable car insurance in Florida.

Coverage level

The level of coverage selected for car insurance in Florida greatly impacts the premiums paid. Understanding the different types of coverage available and their benefits is essential for making informed decisions about insurance protection.

Types of coverage and their impact on premiums

Different levels of coverage can greatly impact the premiums of car insurance in Florida.

- Full coverage policies typically cost more due to all-encompassing and collision coverage.

- Basic liability coverage is usually the most affordable option.

- Adding extras like roadside assistance or rental car coverage can increase premiums.

Importance of understanding coverage options

Understanding coverage options is essential when it comes to determining car insurance rates in Florida. Motor vehicle insurance in Florida offers various coverage options, including liability, comprehensive, and collision coverage.

Tips for Saving on Car Insurance in Florida

To save on car insurance in Florida, consider shopping around for different insurance providers to compare rates.

Another tip is to raise your deductibles, which can lower your premiums.

Additionally, don’t forget to inquire about any discounts that you may be eligible for and explore other strategies that could help reduce your overall car insurance costs.

Shopping around for insurance

When looking to save on car insurance in Florida, it is important to shop around for the best rates and coverage options available.

Compare quotes from multiple insurance companies.

Consider bundling your car insurance with other policies for potential discounts.

Look for any available discounts, such as safe driver or low mileage discounts.

Raising deductibles

Confirming deductibles can be a strategic approach to potentially lower the cost of car insurance in Florida. By opting for a higher deductible, you may be able to reduce your premium payments. However, it’s crucial to verify that you can afford the higher out-of-pocket costs in case of an accident. To help you understand how raising deductibles can impact your car insurance rates, take a look at the table below:

| Deductible Level | Average Annual Premium |

|---|---|

| $500 | $1,200 |

| $1,000 | $1,050 |

| $1,500 | $950 |

| $2,000 | $900 |

Asking about discounts

One effective strategy for reducing car insurance costs in Florida is inquiring about available discounts. Here are some tips for saving on car insurance in Florida:

- Multi-Policy Discount: Bundling your car insurance with other policies like home or renter’s insurance can lead to significant savings.

- Good Student Discount: If you or a family member on your policy is a student with good grades, you may be eligible for a discount.

- Safe Driver Discount: Maintaining a clean driving record without accidents or traffic violations can often result in lower insurance premiums.

Other strategies for reducing car insurance costs

Exploring additional methods to lower car insurance expenses in Florida beyond seeking discounts can help drivers achieve more cost-effective coverage. One strategy is to contemplate raising the deductible on the policy, which can lead to lower monthly premiums.

Additionally, maintaining a clean driving record and avoiding traffic violations can also result in lower insurance costs. Another way to save money on car insurance is to bundle policies, such as combining auto and homeowner’s insurance with the same provider.

Taking a defensive driving course may also qualify for a discount with some insurance companies. Lastly, regularly reviewing and updating coverage limits based on changing circumstances can make sure that drivers are not overpaying for unnecessary coverage.

Conclusion

To conclude, it is essential to recap the key points discussed throughout the article on finding the cheapest car insurance in Florida.

Take the time to compare insurance rates from different providers and carefully consider all factors when selecting a policy that suits your needs.

Understanding car insurance in Florida is vital for making informed decisions that can save you money and provide adequate coverage for your vehicle.

Recap of key points

Considering the discussed facets of car insurance in Florida, a thorough understanding of the different coverage options and cost-saving strategies has been provided.

- Comparing quotes from multiple insurance companies is essential to find the most affordable rates.

- Understanding the minimum coverage requirements in Florida can help you tailor your policy to meet legal standards while keeping costs low.

- Taking advantage of discounts such as safe driver discounts, multi-policy discounts, and good student discounts can greatly reduce your insurance premiums.

Encouragement to compare insurance rates and consider factors when choosing a policy

Having a clear understanding of how insurance rates vary and the factors to take into account when selecting a policy is paramount for obtaining the most suitable and cost-effective car insurance coverage in Florida.

When comparing insurance rates, consider the level of coverage offered, deductibles, discounts available, and the reputation and financial stability of the insurance company.

Factors such as your driving record, the type of vehicle you own, your location, and your credit score can also impact the cost of insurance.

Final thoughts on the importance of understanding car insurance in Florida

Understanding the intricacies of car insurance in Florida is essential for making informed decisions and guaranteeing adequate coverage for your vehicle.

To recap the importance of comprehending car insurance in Florida:

- Legal Compliance: Knowing the state’s minimum insurance requirements helps you avoid penalties and assures you are driving legally.

- Financial Protection: Understanding different coverage options can safeguard you financially in the event of an accident or damage to your vehicle.

- Personalized Policies: Being knowledgeable about car insurance allows you to tailor a policy that meets your specific needs and budget.

Frequently Asked Questions

Can I Get Car Insurance in Florida if I Have a Poor Driving Record?

While having a poor driving record may impact your ability to obtain car insurance in Florida, there are insurance providers that specialize in offering coverage to individuals with such records. It is advisable to shop around for options.

Are There Any Discounts Available for Students or Senior Citizens in Florida?

Discounts for students and senior citizens are common in Florida. Students may benefit from good student discounts, while seniors often qualify for mature driver discounts. These discounts can help reduce insurance premiums for these demographic groups.

Do Car Insurance Rates Vary Based on the Type of Vehicle I Drive in Florida?

Yes, car insurance rates in Florida can vary based on the type of vehicle you drive. Factors such as the make, model, age, and safety features of the vehicle can impact insurance premiums. It’s crucial to take these into account when choosing coverage.

Is It Possible to Get Car Insurance in Florida With a Low Credit Score?

While a low credit score may impact car insurance rates in Florida, it is still possible to obtain coverage. Insurance companies consider various factors beyond credit, such as driving history and type of coverage needed.

Are There Specific Requirements for Minimum Coverage in Florida for Car Insurance?

In Florida, drivers must carry a minimum auto insurance coverage of $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL). These requirements are mandatory for all registered vehicles in the state.