Travel Insurance

Travel insurance is essential for thorough coverage against risks while traveling. It provides financial protection and peace of mind in unforeseen circumstances. Types include trip cancellation, medical travel, and evacuation insurance. Coverage includes medical emergencies, trip cancellations, and baggage loss. Factors like destination, trip duration, and activities impact insurance choice. Purchasing entails evaluating coverage, financial protection, and claim processes. Filing a claim requires proper documentation and following up. Real-life scenarios emphasize the importance of insurance. Learning more about the benefits, types, and exclusions of travel insurance is essential for informed decision-making.

Introduction travel insurance

In the world of travel, the idea of acquiring travel insurance cannot be overstated. This type of protection acts as a safety net, providing coverage for unexpected events that could disrupt or jeopardize a trip. Travel insurance typically includes provisions for trip cancellations, medical emergencies, baggage loss, and travel delays among other potential mishaps.

Brief overview of the importance of travel insurance

Travel insurance is a vital component of trip planning that provides financial protection and peace of mind for travelers in the face of unforeseen events.

- Insurance Policy: Provides a detailed summary of coverage.

- Trip Protection: Safeguards against trip cancellations or interruptions.

- Travel Protection Plan: Offers extensive coverage during travel.

- Insurance Coverage: Guarantees protection against various risks.

- Financial Services: Assists in managing unexpected expenses efficiently.

Explanation of what travel insurance typically covers

Given the importance of mitigating financial risks during travel, a thorough understanding of what travel insurance typically covers is essential for travelers seeking peace of mind and protection against unforeseen events. Travel insurance commonly includes coverage for medical emergencies, trip cancellations, baggage loss, travel delays, and issues related to international travel. Some policies may also cover pre-existing medical conditions, subject to certain conditions and limitations. It is vital to review the deductible, coverage limits, and the claim process when selecting a policy. Additionally, many insurance providers offer emergency assistance hotlines for immediate help in case of need. By familiarizing oneself with the extent of coverage provided, travelers can make sure they are adequately protected during their journeys.

Understanding Travel Insurance

Understanding travel insurance involves grasping its definition and purpose, which is to provide financial protection and peace of mind to travelers in the face of unexpected events. It encompasses a range of coverage options such as trip protection, medical emergency assistance, and reimbursement for losses like trip cancellation or baggage loss. This type of insurance is designed to mitigate risks associated with travel, offering travelers security and support throughout their journeys.

Definition and Purpose

Travel insurance serves as a financial safety net for travelers by providing coverage for unexpected events such as trip cancellations, medical emergencies, or lost baggage. Understanding what travel insurance entails is important for travelers to protect themselves from potential financial losses during their trips. It offers peace of mind and reassurance that one is financially protected in case of unforeseen circumstances while traveling.

What is travel insurance?

Travel insurance provides individuals with financial protection against unforeseen events and emergencies that may occur during their travels.

- Trip protection

- Insurance coverage

- Financial services

- Overseas medical insurance

- Travel assistance

Why is travel insurance essential for travelers?

The necessity of travel insurance becomes evident when unforeseen circumstances pose financial risks to individuals during their journeys. Travel insurance is important as it provides coverage options for travelers, protection against unexpected events, peace of mind while traveling, risk management, financial protection for trips, emergency assistance, reimbursement for trip cancellations, and medical support abroad. It offers travelers a safety net and guarantees they are prepared for any unforeseen events.

Types of Travel Insurance

When considering travel insurance, it is crucial to comprehend the various types available to meet different needs. Trip cancellation insurance provides coverage in case you need to cancel your trip unexpectedly, while trip interruption insurance covers you if your trip is cut short. Medical travel insurance guarantees you are protected in case of medical emergencies abroad, evacuation insurance covers the cost of being transported to a medical facility, and baggage and personal items loss insurance offers coverage for lost or damaged belongings during your travels.

Trip Cancellation Insurance

Commonly included in all-encompassing travel insurance plans, trip cancellation insurance provides financial protection in case unforeseen circumstances force you to cancel your trip. Trip cancellation insurance offers various benefits and features, including:

- Coverage for pre-existing medical conditions

- Clear coverage limits and deductible information

- Streamlined claim process for reimbursement

- Access to an emergency assistance hotline for immediate support

- Financial protection against unexpected events like weather-related trip cancellations

This type of insurance guarantees that you can recoup some or all of your expenses if you need to cancel your trip due to covered reasons. Understanding the specifics of your trip cancellation insurance policy is essential to being prepared for any unforeseen events that may arise.

Trip Interruption Insurance

Providing coverage for unexpected disruptions to your travels, Trip Interruption Insurance is an essential component of all-encompassing travel insurance plans. This type of insurance offers financial protection by reimbursing you for prepaid and non-refundable trip expenses if you have to cut your trip short due to unforeseen events such as illness, natural disasters, or other emergencies. Coverage limits vary among policies, so it’s important to review the terms carefully. Trip interruption insurance often includes an emergency assistance hotline for immediate help and guidance. In the event of a covered interruption, the claim process typically involves submitting documentation to support your reimbursement request. Additionally, some policies may offer personal liability coverage and even provisions for travel delay entertainment.

Medical Travel Insurance

Medical travel insurance is an essential component of thorough travel insurance plans, offering coverage for various healthcare needs during international or domestic travel.

- Overseas medical insurance provides coverage for medical expenses incurred abroad.

- Pre-existing medical conditions may require special coverage considerations.

- Emergency assistance hotlines offer immediate support in medical emergencies.

- Trip cancellation insurance can reimburse non-refundable expenses due to unexpected events.

- Coverage limits and deductibles should be carefully reviewed to understand the extent of reimbursement in case of a medical emergency.

Evacuation Insurance

Evacuation insurance, a vital aspect of all-encompassing travel insurance plans, provides essential coverage for emergency medical evacuations during domestic or international travel. In times of medical emergencies or unexpected events, having evacuation insurance offers peace of mind and financial protection. This type of insurance typically includes emergency evacuation services, access to an emergency assistance hotline, and risk management for various situations like political evacuation coverage. By securing evacuation insurance, travelers ensure they can swiftly and safely be transported to the nearest adequate medical facility or even repatriated to their home country if necessary. This coverage is a crucial component of travel safety, offering travelers a sense of security in potentially challenging situations.

| Key Aspect | Description |

|---|---|

| Emergency Evacuation | Swift transportation to medical facilities or repatriation in case of emergencies |

| Financial Protection | Coverage for evacuation costs and related expenses in unforeseen circumstances |

| Peace of Mind | Assurance and security knowing that emergency evacuation assistance is available |

Baggage and Personal Items Loss

One essential aspect to take into account when selecting a travel insurance policy is coverage for loss of baggage and personal items.

- Coverage Limits: Make sure you are aware of the maximum amount the insurance will reimburse for lost or damaged items.

- Claim Process: Familiarize yourself with the steps required to file a claim in case of baggage loss.

- Reimbursement: Understand the process and timeline for receiving reimbursement for your lost luggage or personal items.

- Unexpected Events: Travel insurance provides peace of mind in case of unexpected events such as baggage loss during your trip.

- Financial Protection: Travel insurance offers financial protection by covering the costs associated with lost or damaged personal belongings.

Accidental Death and Flight Accident Coverage

Accidental death and flight accident coverage are fundamental components of various types of travel insurance policies, offering protection in unforeseen circumstances during travel. Accidental death coverage provides a lump sum payment to the beneficiary in the event of the insured’s death due to a covered accident while traveling. Flight accident coverage specifically pertains to accidents that occur while on a flight. These components are typically included in standard travel insurance policies to provide financial protection, peace of mind, and risk management for travelers. Coverage limits for accidental death and flight accidents vary depending on the insurance policy. Additionally, many insurance providers offer an emergency assistance hotline for travelers to access help in case of emergencies and streamline the reimbursement process.

What Travel Insurance Covers

Travel insurance offers a range of coverage, including protection against trip cancellations, interruptions, and delays. Additionally, it provides coverage for medical emergencies and evacuation, outlining the scope and limitations of such services. Special circumstances such as coverage for lost, stolen, or damaged luggage, as well as considerations for adventure sports, pre-existing conditions, and the impact of events like COVID-19, are also addressed within travel insurance policies.

Detailed explanation of coverage for cancellations, interruptions, and delays

In cases of unforeseen circumstances such as trip interruptions, cancellations, or delays, travel insurance provides coverage to protect travelers financially and offer peace of mind. Travel insurance typically includes:

- Trip cancellation coverage for reimbursement of prepaid and non-refundable trip expenses in case of unforeseen events.

- Trip interruption coverage for expenses related to cutting a trip short due to covered reasons.

- Trip delay coverage for additional expenses incurred due to covered delays.

- Coverage limits and deductibles that outline the maximum amount payable and the initial amount the insured has to cover.

- Claim process guidance to assist policyholders in maneuvering the reimbursement process efficiently.

Medical emergencies and evacuation: scope and limitations

During unforeseen medical emergencies during travel, travel insurance provides coverage for necessary medical care and evacuation services, subject to specific limitations and conditions. In the event of a medical emergency, policyholders can contact the emergency assistance hotline for immediate support and guidance. However, it’s essential to note that coverage limitations may apply, especially regarding pre-existing medical conditions. Travel insurance offers peace of mind by ensuring financial protection in unexpected events that require medical attention and evacuation. The reimbursement process for medical expenses incurred during travel varies, so understanding the policy details is vital. Here are some travel safety tips to maximize the benefits of travel insurance:

| Travel Safety Tips | Emergency Assistance Hotline | Coverage Limitations |

|---|---|---|

| Stay Informed | Call for Immediate Help | Check Policy Terms |

| Pack Essentials | Seek Guidance | Understand Exclusions |

Coverage for lost, stolen, or damaged luggage

When faced with the unfortunate circumstance of lost, stolen, or damaged luggage while traveling, understanding the coverage provided by travel insurance becomes paramount for travelers seeking financial protection.

- Lost luggage assistance: Travel insurance can provide support in locating and recovering lost luggage.

- Baggage loss coverage: Policies typically offer reimbursement for lost belongings up to a certain limit.

- Claim process for lost luggage: Travelers need to follow specific procedures, such as submitting a lost luggage claim form, to seek reimbursement.

- Damaged luggage compensation: Insurance may cover repair costs or provide compensation for damaged items.

- Baggage delay coverage: In case of delayed luggage, insurance can offer coverage for essential items until the bags are returned.

Special circumstances: adventure sports, pre-existing conditions, and COVID-19

Special considerations arise when evaluating the coverage provided by travel insurance for adventure sports, pre-existing conditions, and the impact of COVID-19 on travel plans. Travel insurance for high-risk activities, such as extreme sports, often requires additional premiums or specialized policies to cover potential injuries. Individuals with pre-existing medical conditions should carefully review policy details to guarantee coverage for unexpected medical issues abroad. With the ongoing pandemic, travelers should assess COVID-19 coverage, including quarantine expenses and trip cancellation due to the virus. It is essential to grasp any travel insurance exclusions related to COVID-19. Additionally, policies may offer emergency medical evacuation in case of illness. Travelers engaging in adventurous activities should consider medical waivers and all-inclusive coverage to mitigate risks associated with their pursuits.

Choosing the Right Travel Insurance

When selecting the right travel insurance, it is important to take into account the factors that influence the cost, such as the destination, duration of the trip, and activities planned. Evaluating travel insurance providers based on their reputation, customer reviews, and claim process efficiency is vital to guarantee reliable coverage. Knowing when to purchase travel insurance, whether at the time of booking or closer to the departure date, can also impact the level of protection and benefits provided.

Factors Influencing Travel Insurance Cost

When considering travel insurance costs, several factors come into play. The price of insurance can be influenced by the trip’s overall cost, duration, and chosen destination. Additionally, individual variables like age, health status, and optional add-ons can impact the final insurance rates.

How trip cost, duration, and destination affect insurance pricing

The pricing of travel insurance is influenced by factors such as the trip cost, duration, and destination, all of which play a significant role in determining the coverage and premiums offered to travelers.

- Trip cost

- Duration of the trip

- Destination of travel

- Coverage limits

- Deductible

The impact of travelers age and health on insurance rates

A critical factor influencing travel insurance rates is the age and health condition of the traveler, as these aspects play a significant role in determining the coverage options and premiums available. Insurance rates may vary based on age group, pre-existing medical conditions, health status, and age restrictions. Senior travelers with pre-existing medical conditions might face higher rates due to increased risk, impacting coverage limits and deductible amounts.

Optional add-ons and their effect on the overall cost

Influencing the overall cost of travel insurance, optional add-ons provide policyholders with the opportunity to customize their coverage based on specific needs and preferences.

- Trip protection enhancements

- Adjusting coverage limits and deductible

- Access to emergency assistance hotline

- Additional coverage for pre-existing medical conditions

- Consideration of regional variations and age restrictions

Evaluating Travel Insurance Providers

When assessing travel insurance providers to select the appropriate travel insurance, it is essential to take into account the reputation and trustworthiness of insurance companies. Moreover, reviewing customer testimonials and feedback can offer valuable insights into the quality of service provided. Comparing policy terms and coverage limits among various providers is vital to guarantee that the selected insurance meets individual travel needs and preferences.

Reputation and reliability of insurance companies

With a plethora of options available in the market, evaluating the reputation and reliability of insurance companies is paramount when selecting the right travel insurance provider.

- Check insurance companies’ reputation

- Assess reliability based on claim process

- Review coverage limits in policies

- Evaluate availability of emergency assistance hotline

- Consider regional variations and customizable coverage options

Customer reviews and feedback

Customer reviews and feedback play an important role in the process of evaluating travel insurance providers, providing valuable insights into the actual experiences of policyholders. Understanding how well a company handles trip protection, insurance coverage, claim process, financial protection, and unexpected events can influence the decision-making process. Positive reviews about reimbursement, customizable coverage options, and overall peace of mind can help travelers choose the right insurance provider.

Comparison of policy terms and coverage limits

A critical aspect when evaluating travel insurance providers is comparing the policy terms and coverage limits they offer to ensure extensive protection during your travels.

- World Nomads and Travel Insured brand names

- Coverage for high-risk activities

- Destination-specific coverage

- Cruise insurance options

- Backpacker insurance plans

When to Buy Travel Insurance

Timing is vital when it comes to purchasing travel insurance. Buying early can provide advantages such as coverage for pre-existing conditions and the option to cancel for any reason. Knowing when to purchase can guarantee you get the most out of your travel insurance policy.

The best time to purchase travel insurance

Determining the optimal moment to secure travel insurance is a pivotal decision in safeguarding your trip and mitigating unforeseen risks.

- Research various travel insurance options available.

- Consider the insurance coverage and trip protection offered.

- Evaluate the financial protection provided by different plans.

- Understand the claim process for different insurers.

- Compare offerings from travel agencies, online aggregators, travel bloggers, YouTubers, and travel booking platforms.

Early purchase benefits: coverage for pre-existing conditions and ‘cancel for any reason’ options

Securing travel insurance early offers valuable benefits, including coverage for pre-existing conditions and the option to cancel for any reason. This trip protection guarantees thorough insurance coverage and financial services in case of trip cancellation, medical emergencies, or other unforeseen events. Understanding deductible and coverage limits is essential, as it impacts the claim process and financial protection during travel.

How to Purchase Travel Insurance

When looking to purchase travel insurance, it is essential to understand the steps involved in acquiring a policy that suits your specific needs. Different types of travelers, such as families with kids in Southeast Asia, seniors with pre-existing medical conditions, or those planning short weekend getaways in Europe, require tailored insurance coverage. By considering the points related to steps to acquire a policy and travel insurance for different types of travelers, individuals can make informed decisions when purchasing travel insurance.

Steps to Acquire a Policy

When looking to buy travel insurance, it is essential to start by selecting a policy that aligns with your specific needs and travel plans. Understanding the fine print of the insurance, including exclusions and coverage limits, is important to make sure you are adequately protected. The purchasing process can typically be done online, through insurance agents, or even travel operators, offering various options for acquiring the necessary coverage.

Selecting the right policy for your needs

To guarantee comprehensive coverage tailored to your specific travel needs, it is crucial to carefully assess and select the most appropriate travel insurance policy.

- Consider your travel style and activities

- Check coverage for pre-existing medical conditions

- Evaluate trip cancellation benefits

- Ensure financial protection and emergency evacuation coverage

- Understand the claim process for medical care abroad

Understanding the fine print: exclusions and limits

Understanding the exclusions and limits outlined in a travel insurance policy is vital for ensuring full comprehension of the coverage provided. It is essential to be aware of exclusions such as pre-existing medical conditions, trip cancellation reasons, deductible amounts, coverage limits, and any age restrictions. Additionally, policies may have regional variations in coverage and specific exclusions like high-risk activities or personal liability limits.

The purchasing process: online, through agents, or travel operators

The process of acquiring travel insurance can be completed through various channels, including online platforms, insurance agents, or travel operators.

- Online aggregators offer quick comparisons.

- Insurance companies provide detailed policy options.

- Travel operators offer package deals.

- Customer reviews help in decision-making.

- Government tourism websites may have specific recommendations.

Travel Insurance for Different Types of Travelers

When considering travel insurance for different types of travelers, it is important to tailor the insurance policy to specific travel needs and activities. Whether it is solo travelers, families, students, or business travelers, understanding the unique requirements of each group is essential in ensuring adequate coverage. By customizing insurance plans to cater to the diverse needs of travelers, individuals can have peace of mind knowing they are protected during their journeys.

Solo travelers, families, students, and business travelers

For solo travelers, families, students, and business travelers, selecting the appropriate travel insurance involves considering various factors such as trip duration, destination, activities planned, age group, and travel style.

- Trip protection options

- Overseas medical insurance coverage

- Access to emergency assistance hotline

- Tailored travel safety tips

- Understanding regional variations in coverage

Tailoring insurance to specific travel needs and activities

Tailoring insurance to specific travel needs and activities involves a meticulous analysis of factors such as trip duration, destination, planned activities, age group, and travel style for best coverage selection. For a family with kids in Southeast Asia, all-encompassing coverage is crucial. Seniors with pre-existing medical conditions may require specialized policies. Short weekend getaways in Europe call for affordable yet sufficient insurance plans tailored to the short duration.

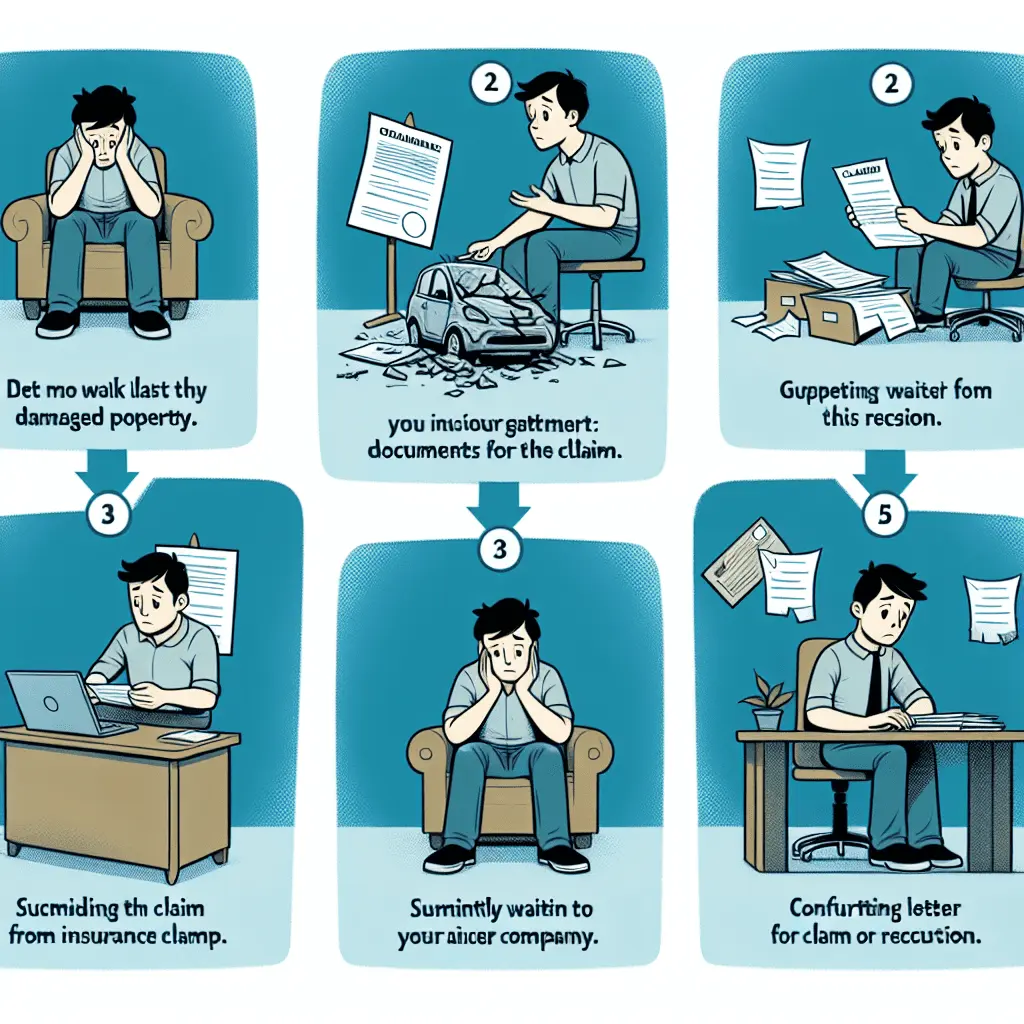

Filing a Claim: The Process Explained

When it comes to travel insurance, understanding the process of filing a claim is essential. Knowing what steps to take before you travel, how to navigate the claims process, and learning from real-life scenarios and case studies can help travelers effectively handle unexpected situations. By familiarizing oneself with the nuances of filing a claim, travelers can guarantee they receive the necessary support and reimbursement when faced with travel-related issues.

Before You Travel

When it comes to filing a claim with your travel insurance provider, proper documentation and preparation are essential. Keeping track of receipts and important paperwork, such as medical reports or police reports in the case of theft, can streamline the claims process. By being organized and thorough in your record-keeping, you can guarantee a smoother and more efficient resolution to any insurance claims you may need to file.

Documentation and preparation tips

Before embarking on your journey, it is crucial to familiarize yourself with the necessary documentation and preparation suggestions for submitting a claim with your travel insurance provider to ensure a smooth process in case of unforeseen events.

- Review travel advisories

- Verify travel visa and vaccination requirements

- Maintain records of flight and accommodation bookings

- Comprehend local transportation options

- Guarantee you have essential travel documentation and information on lost passport assistance

Keeping track of receipts and important paperwork

Keeping meticulous records of receipts and essential paperwork is paramount when preparing to file a claim with your travel insurance provider, ensuring a seamless process in the event of unforeseen circumstances. To highlight the importance, refer to the table below:

| Documentation | Importance |

|---|---|

| Receipts for Expenses | Essential for Claim Processing |

| Travel Insurance Policy | Verify Coverage Details |

| Identification Documents | Proof of Identity |

| Medical Reports | Supporting Medical Claims |

The Claims Process

Understanding the claims process is vital for travelers seeking reimbursement for unforeseen incidents. A step-by-step guide to filing a claim can help individuals navigate the process efficiently. Additionally, knowing what to do in case a claim is denied and the role of customer support during this process are essential aspects to take into account.

Step-by-step guide to filing a claim

How does one navigate the intricate process of filing a travel insurance claim seamlessly and efficiently?

- Review your policy details thoroughly.

- Collect all necessary documentation.

- Contact your insurance provider promptly.

- Submit your claim with accurate information.

- Follow up on the claim status regularly.

What to do if a claim is denied

In the event that a claim is denied, it is essential to carefully review the reasons provided by the insurance provider before taking further action. Understand the policy terms, conditions, and exclusions that may have led to the denial. If you believe the denial is unjustified, gather all relevant documentation to support your case and consider appealing the decision following the insurance company’s formal appeals process.

The role of customer support during the claims process

Customer support plays an essential role during the claims process of travel insurance, providing assistance and guidance to policyholders maneuvering the complexities of filing a claim.

- Assisting customers in understanding required documentation.

- Addressing inquiries promptly and professionally.

- Offering guidance on the claims process timeline.

- Providing updates on claim status.

- Resolving any issues or concerns efficiently.

Real-Life Scenarios and Case Studies

When it comes to travel insurance, real-life scenarios and case studies play a vital role in understanding the value and benefits of having coverage. Examples of travelers who have encountered unforeseen circumstances and successfully filed claims can shed light on the importance of being prepared. By examining these instances, individuals can grasp the significance of investing in travel insurance for their peace of mind and financial protection.

Examples of when travel insurance was beneficial

Travel insurance has often come to the rescue in unforeseen circumstances, providing peace of mind and financial protection to travelers around the globe.

- Cancelled flights due to severe weather conditions

- Medical emergencies requiring hospitalization abroad

- Lost luggage containing essential items

- Trip cancellations due to unforeseen personal reasons

- Rental car damages during a vacation

Stories of travelers who benefited from having travel insurance

In real-life scenarios and case studies, instances abound where travelers have found immense value and peace of mind from having travel insurance coverage. From medical emergencies to trip cancellations or lost luggage, travel insurance has proven to be a crucial lifeline for many individuals. These stories highlight the importance of being prepared for unexpected events while traveling and the reassurance that insurance can provide in challenging situations.

Frequently Asked Questions

Can I Purchase Travel Insurance for a One-Way Trip or Does It Only Cover Round-Trip Journeys?

Travel insurance typically covers both one-way and round-trip journeys. The key factor is the coverage duration. Policies may have specific terms for trip lengths and what qualifies as a covered trip, so reviewing policy details is essential.

Are There Any Exclusions in Travel Insurance Policies That I Should Be Aware Of, Such as Coverage for High-Risk Activities or Certain Medical Conditions?

Exclusions in insurance policies often include limitations on coverage for high-risk activities, specific medical conditions, and pre-existing conditions. It is important to review policy details to understand what is covered and any potential exclusions.

How Does Travel Insurance Handle Situations Where I Have Multiple Destinations Within One Trip, Especially if They Are in Different Countries With Varying Levels of Risk?

When traveling to multiple destinations with varying risk levels, it’s vital to assess safety factors for each area. Consider local laws, health risks, political stability, and access to emergency services. Plan accordingly to minimize potential risks and guarantee a safe journey.

Is It Possible to Extend My Travel Insurance Coverage While I Am Already on My Trip if I Decide to Stay Longer Than Initially Planned?

Yes, prolonging travel insurance coverage during a trip is possible by contacting the insurance provider. This guarantees continued protection against unforeseen events. It’s advisable to review policy terms and any additional costs associated with the extension.

What Happens if My Travel Insurance Provider Goes Out of Business or Files for Bankruptcy While I Am on My Trip and Need to Make a Claim?

In the unfortunate event of your travel insurance provider going bankrupt during your trip, the ability to make a claim may be compromised. It is essential to seek guidance from relevant regulatory bodies or legal counsel for potential recourse options.

Conclusion

In summary, travel insurance serves as an essential safety net for mitigating risks associated with unforeseen events during trips. It provides travelers with a sense of security and peace of mind, knowing that they are protected financially in case of emergencies. Understanding the significance of travel insurance can help individuals make informed decisions to safeguard their journeys.

Recap of the importance of travel insurance

Highlighting the importance of protecting your travel experience with sufficient insurance coverage is essential for reducing unexpected risks and ensuring peace of mind throughout your journey.

- Provides financial protection in case of trip cancellation or interruption

- Covers medical emergencies and evacuation expenses

- Offers assistance in case of lost baggage or travel delays

- Protects against unforeseen events such as natural disasters or political unrest

- Gives you peace of mind knowing you have support and coverage while traveling

Final thoughts on ensuring peace of mind while traveling

To truly safeguard your travel experiences and guarantee a worry-free journey, it is essential to prioritize all-encompassing travel insurance that addresses all potential risks and uncertainties you may encounter while away from home. Extensive coverage not only provides financial protection against unforeseen events such as trip cancellations, medical emergencies, or lost baggage but also offers peace of mind knowing that you are prepared for any situation. When selecting a travel insurance policy, carefully review the coverage limits, exclusions, and benefits to make sure it aligns with your specific travel needs. By investing in the right travel insurance plan, you can mitigate the impact of unexpected occurrences and focus on enjoying your travels with confidence and security.