Buckle Up for Change: Car Insurance in a Tech-Driven Future (2024-2030)

Car insurance is an essential financial safeguard that offers protection in situations like accidents, theft, or damage, ensuring necessary legal compliance and peace of mind for car owners. Understanding the various coverage options, factors affecting rates, and how to select the right policy are vital steps in securing adequate protection. By exploring state-specific requirements, the claims process, and tips for lowering premiums, individuals can make informed decisions to safeguard their vehicles and finances effectively.

Introduction to Car Insurance Insurancelist.com

Auto insurance functions as a vital financial safeguard for car owners by offering protection in the event of accidents, theft, or damage to the vehicle. Grasping how car insurance works entails understanding the concepts of premiums, deductibles, and coverage levels customized to individual needs. Additionally, adhering to the legal obligation of having car insurance is mandatory in most jurisdictions to guarantee financial responsibility in the event of an accident.

Brief overview of car insurance and its importance

Vehicle insurance, also referred to as car insurance, is an essential financial safeguard that provides protection against potential losses resulting from accidents or other unforeseen events involving a motor vehicle. Understanding the significance of car insurance is vital for all drivers. Here are some key points to ponder:

- Legal Requirement: Most states mandate some form of auto insurance to lawfully operate a vehicle.

- Financial Protection: Car insurance can assist in covering repair costs, medical expenses, and legal fees in case of an accident.

- Peace of Mind: Knowing you are financially protected in case of unexpected events can offer peace of mind.

- Asset Protection: Insurance helps safeguard your vehicle, a valuable asset, from various risks.

Having the appropriate car insurance policy tailored to your needs is crucial for responsible vehicle ownership.

Explanation of how car insurance works

Understanding the mechanics of car insurance involves delving into the intricate framework of financial protection, coverage options, and legal obligations associated with owning and operating a motor vehicle. When considering car insurance, individuals can obtain policies through car insurance agents or directly from companies offering auto insurance. Factors such as the deductible, coverage limits, and payment options play an important role in determining the extent of financial protection provided. It is essential to obtain an auto insurance quote to understand the cost implications and available coverage options. Additionally, features like roadside assistance and protection against uninsured motorists may be included in the policy. Exploring different options can help individuals find the cheapest car insurance that meets their specific needs.

The legal necessity of car insurance in most regions

The mandatory requirement for automobile insurance in most jurisdictions underscores the vital role it plays in providing financial protection and legal compliance for drivers. Car insurance near me and understanding auto owners insurance, cheap auto insurance, and the specifics of progressive auto insurance, state farm car insurance, and USAA car insurance are essential for all drivers. Key aspects such as liability protection and medical payments are fundamental components of a policy, whether opting for full coverage car insurance or meeting minimum car insurance requirements. Understanding these factors not only guarantees compliance with the law but also safeguards individuals and their assets in the event of unforeseen circumstances on the road.

Types of Car Insurance Coverage

In the domain of car insurance coverage, a plethora of options exists to cater to various aspects of protection. These encompass Liability Insurance for both Bodily Injury and Property Damage, Collision Coverage, All-encompassing Coverage, Uninsured/Underinsured Motorist Coverage, and Medical Payments Coverage or Personal Injury Protection (PIP). Each type serves a distinct purpose in safeguarding the policyholder against different risks and potential financial losses.

Liability Insurance (Bodily Injury & Property Damage)

Covering bodily injury and property damage, liability insurance is a fundamental component of car insurance coverage. When selecting liability insurance, it’s important to understand the coverage limits, claims process, deductible, and the reputation of insurance companies. Here are four key points to keep in mind:

- Coverage Limits: Make sure you have sufficient coverage to protect your assets in case of a severe accident.

- Claims Process: Familiarize yourself with the steps involved in making a claim under your liability insurance policy.

- Deductible: Understand the amount you must pay out of pocket before your insurance coverage kicks in.

- Insurance Companies: Research and compare different insurance providers to find the best car insurance companies offering inclusive coverage options.

Collision Coverage

Investigating the domain of car insurance coverage, Collision Coverage is an essential component that protects against damages to your vehicle in the event of a collision. This type of insurance helps cover the costs of repairing or replacing your car if it is damaged in a crash, regardless of fault. Collision insurance is distinct from liability insurance as it focuses solely on damage to your vehicle. It is particularly important for high-risk drivers, such as teenagers, individuals with DUIs, or those needing SR-22 insurance. Classic car owners also often opt for collision coverage to protect their valuable vehicles. Understanding the nuances of collision insurance is essential when selecting the right drivers insurance policy.

Comprehensive Coverage

Extensive coverage, a crucial component of auto insurance policies, provides protection for your vehicle against a wide range of non-collision related damages and incidents. All-encompassing coverage goes beyond just accidents, offering a safety net for various unpredictable situations. Here are some key points to understand about all-encompassing coverage:

- Coverage Details: All-encompassing insurance typically covers theft, vandalism, natural disasters, and animal collisions.

- Insurer Options: Companies like AAA Auto Insurance, GEICO Car Insurance, and USAA Auto Insurance offer all-encompassing coverage.

- Benefits: The General Car Insurance and Progressive Car Insurance are known for their all-encompassing coverage benefits.

- Regional Variations: Motor insurance in the UK may offer different all-encompassing coverage options compared to the most affordable car insurance in California.

Uninsured/Underinsured Motorist Coverage

After gaining a thorough understanding of all-inclusive coverage within auto insurance policies, it is important to discuss the significance and intricacies of Uninsured/Underinsured Motorist Coverage as an essential component of ensuring financial protection in the event of an accident involving a driver with inadequate insurance. Uninsured motorist coverage provides protection if you’re involved in an accident with a driver who doesn’t have insurance, while underinsured motorist coverage helps when the at-fault driver’s insurance is insufficient to cover your expenses. It is critical to be aware of the coverage limits and deductible associated with these types of coverage. In the unfortunate event of an accident, understanding the claims process and having adequate liability protection can make a significant difference. Additionally, some insurance companies offer roadside assistance as part of these coverage options. Remember to inquire about these aspects when obtaining a car insurance quote.

Medical Payments Coverage / Personal Injury Protection (PIP)

Medical Payments Coverage, also known as Personal Injury Protection (PIP), is an essential component of car insurance policies that provides financial assistance for medical expenses incurred by the policyholder and passengers in the event of an accident. This coverage can be pivotal in ensuring that medical bills are taken care of promptly, regardless of who was at fault in the accident. Key points to note about Medical Payments Coverage / PIP include:

- Offers additional protection beyond basic liability insurance.

- Can help cover medical expenses, lost wages, and funeral costs.

- Available in ‘no-fault’ states where each party’s insurance covers their own injuries.

- Can be used in conjunction with health insurance to cover deductibles and copayments.

Additional Coverage Options (e.g., Gap Insurance, Rental Reimbursement)

Following the discussion on Medical Payments Coverage / Personal Injury Protection (PIP) in car insurance policies, an important aspect to ponder is the availability of Additional Coverage Options such as Gap Insurance and Rental Reimbursement. Gap Insurance, often recommended for leased or financed vehicles, covers the difference between the actual cash value of a car and the balance still owed on the loan in the event of a total loss. Rental Reimbursement, on the other hand, helps cover the cost of a rental car while your vehicle is being repaired due to a covered claim, such as an accident. Understanding these additional coverage options is vital in ensuring adequate protection for your vehicle and financial security in various scenarios within the claims process and coverage limits.

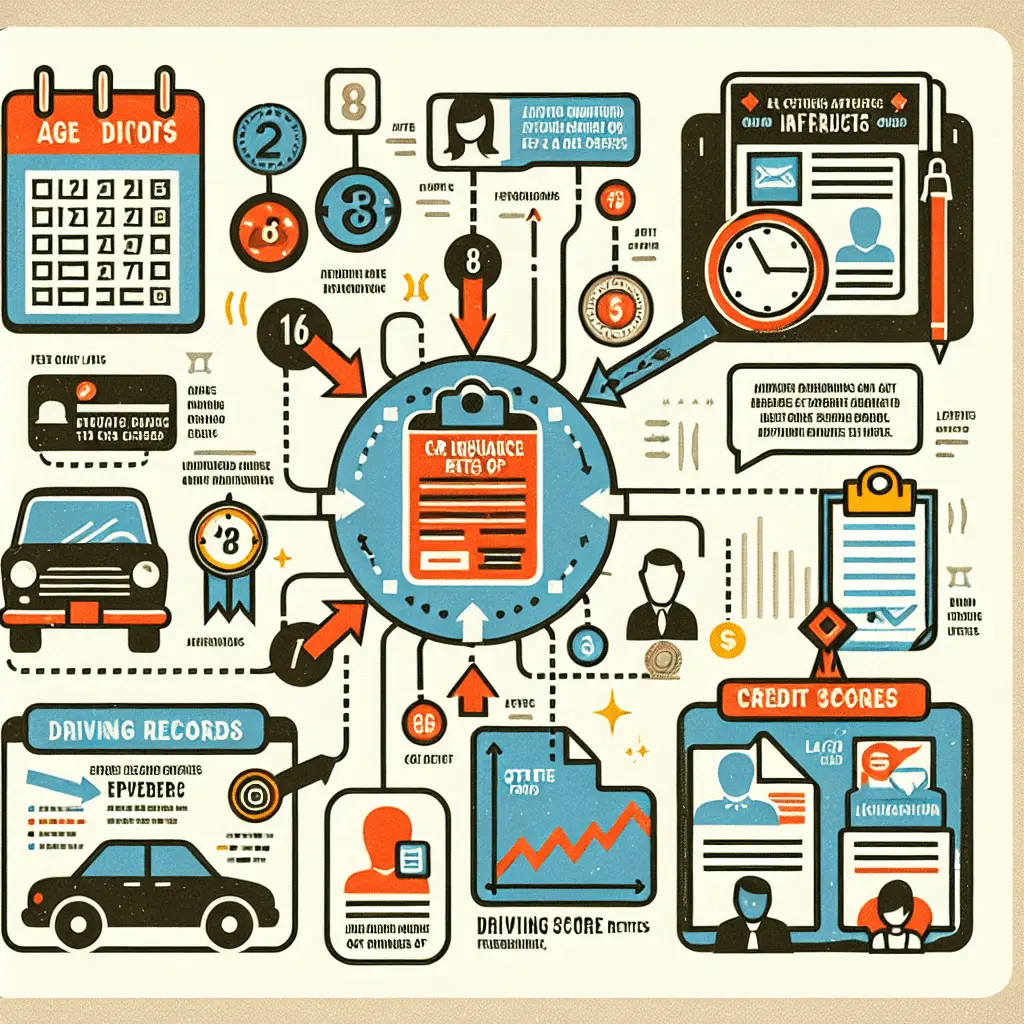

Factors That Affect Car Insurance Rates

Various factors play an essential role in determining car insurance rates. These include age and driving experience, driver’s record, credit score (if applicable), car’s make and model, and the location along with state regulations. Each of these elements is carefully assessed by insurance companies to calculate the risk associated with insuring a particular driver and vehicle.

Car Insurance Quotes 2024 in US

| Car Insurance Quotes In US | ||

| TT | Driver Profile | Average Annual Rate |

| 1 | 20-year-old male | $4,452 |

| 2 | 20-year-old female | $3,250 |

| 3 | 30-year-old male | $1,950 |

| 4 | 30-year-old female | $1,600 |

| 5 | 40-year-old male | $1,400 |

| 6 | 40-year-old female | $1,200 |

| 7 | 50-year-old male | $1,200 |

| 8 | 50-year-old female | $1,000 |

| 9 | 60-year-old male | $1,000 |

| 10 | 60-year-old female | $900 |

Age and Driving Experience

Age and driving experience are significant factors that play an important role in determining car insurance rates. When insurance companies assess these variables, several key considerations come into play:

- Youthful Drivers: Teenagers often face higher premiums due to their lack of experience and higher risk profile.

- Senior Drivers: Older drivers may also see increased rates, as age-related changes can impact driving abilities.

- Driving Record: A history of accidents or traffic violations can lead to elevated insurance costs.

- Driving Experience: The length of time a driver has been licensed influences rates, with more experienced drivers generally benefiting from lower premiums.

These factors highlight the importance of age and driving experience in shaping car insurance pricing.

Driving Record and Traffic Violations

An individual’s driving record and history of traffic violations strongly influence the determination of car insurance rates, reflecting the risk profile assessed by insurance companies. A clean driving record typically leads to lower insurance premiums, as it suggests a lower likelihood of accidents. On the contrary, a record with traffic violations, accidents, or DUIs may result in higher premiums due to the increased risk associated with such drivers. Insurance companies also consider factors like liability protection, coverage limits, deductible amounts, uninsured motorist coverage, and the claims process when determining rates. Those with a history of violations or accidents may be classified as high-risk drivers and could require specialized high-risk car insurance. It’s important to review payment options and policy details carefully to guarantee appropriate coverage.

Credit Score (where applicable)

Credit scores, where applicable, play a significant role in determining car insurance rates, impacting the financial risk assessment conducted by insurance providers. When considering auto insurance premiums, your credit score can have a notable impact. Here are some key points to understand:

- Credit Score Importance: It influences the premium you pay.

- Lower Scores, Higher Premiums: Poor credit can lead to increased rates.

- Impacts on Coverage Limits: Credit score may affect the coverage options available to you.

- Payment Options: Some insurers offer flexible payment plans based on credit scores.

Understanding how credit scores affect your insurance policy can help you navigate the complexities of selecting the best car insurance companies.

Car Make and Model

When evaluating car insurance rates, one important factor that greatly impacts costs is the make and model of the vehicle being insured. Insurance companies consider the car make and model as they analyze the risk associated with insuring a particular vehicle. Certain makes and models may be more prone to theft or expensive to repair, leading to higher insurance premiums. Additionally, luxury cars or sports cars typically have higher insurance rates due to their higher value and increased likelihood of being involved in accidents. Below is a table illustrating how different car makes and models can influence insurance rates:

| Car Make | Car Model | Impact on Insurance Rates |

|---|---|---|

| Toyota | Camry | Lower rates |

| BMW | X5 | Higher rates |

| Honda | Civic | Moderate rates |

| Ford | Mustang | Higher rates |

Location and State Regulations

Location and State Regulations play a significant role in determining car insurance rates, as they are influenced by various factors specific to each geographical area. When considering auto insurance, it’s important to understand how your location and state regulations impact your coverage and premiums:

- Minimum Car Insurance Requirements: States have varying minimum coverage requirements that affect your policy cost.

- Insurance Companies: Different insurers may offer varying rates based on the location you reside in.

- Deductible: The amount you choose can impact your premiums and out-of-pocket expenses.

- Payment Options: Some locations offer discounts for certain payment methods, affecting the overall cost of your insurance policy.

Understanding these factors can help you navigate the complex world of car insurance effectively.

Gender and Marital Status

Gender and marital status are key factors that greatly influence car insurance rates, impacting the premiums individuals pay for their coverage. Insurance companies often consider statistical data when determining rates based on gender and marital status. Below is a table illustrating how these factors can affect car insurance rates:

| Category | Male | Female |

|---|---|---|

| Single | Higher rates | Lower rates |

| Married | Lower rates | Lower rates |

| Divorced | Higher rates | Higher rates |

These rates vary based on risk assessment by the insurance company. Factors such as driving history, age, and type of coverage also play a role in determining the final premium. Understanding how gender and marital status influence car insurance rates can help individuals make informed decisions when selecting coverage options.

Annual Mileage

The number of miles driven annually is a significant factor in determining car insurance rates, with higher mileage often correlating to increased risk and potentially higher premiums. When considering annual mileage in relation to car insurance, several key points come into play:

- Vehicle Coverage: The extent of coverage your policy provides for your vehicle.

- Comprehensive Coverage: Protection for damages not caused by a collision.

- Liability Protection: Coverage for damages or injuries you may cause to others.

- Deductible: The amount you agree to pay out of pocket before your insurance kicks in.

These factors, along with your annual mileage, can impact your insurance rates, claims process, and the types of coverage, such as high-risk car insurance or roadside assistance, that may be recommended for your needs.

How to Choose the Right Car Insurance Policy

When selecting the appropriate car insurance policy, it is vital to first evaluate your coverage requirements based on your driving habits and vehicle type. Understanding the policy limits and deductibles is critical to guarantee that you have adequate protection in case of an accident. Additionally, comparing quotes from various insurers, evaluating their reputation, and considering available discounts can help you make an informed decision regarding your car insurance policy.

Assessing Your Coverage Needs

Determining the appropriate level of coverage for your car insurance policy involves evaluating various factors related to your driving habits, vehicle, and financial situation. When evaluating your coverage needs, consider the following key aspects:

- Liability Protection: Assess the amount of liability coverage required by your state and consider additional coverage for extra protection.

- Comprehensive Coverage: Decide if you need coverage for non-collision incidents like theft, vandalism, or natural disasters.

- Deductible: Choose a deductible amount that fits your budget and financial capabilities.

- Uninsured Motorist and Roadside Assistance: Determine if you need coverage for accidents involving uninsured drivers and if roadside assistance is necessary for you.

Research and compare offerings from the best car insurance companies to find a policy that meets your requirements.

Understanding Policy Limits and Deductibles

Understanding the relationship between policy limits and deductibles is essential when selecting the appropriate car insurance coverage. Policy limits refer to the maximum amount your insurance company will pay out for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in. When choosing an insurance policy, consider the balance between your deductible and coverage limits. Lower deductibles usually mean higher premiums, and higher coverage limits can also increase premiums. It’s vital to understand how these factors affect your premium costs and potential out-of-pocket expenses in the event of a claim. Different insurance companies offer various payment options, so comparing policies to find the best fit for your needs is advisable.

Comparing Quotes from Multiple Insurers

To make an informed decision on selecting the right car insurance policy, it is essential to compare quotes from multiple insurers. This process allows you to evaluate various aspects of the coverage offered by different insurance companies. Here are some key reasons why comparing quotes is vital:

- Cost: Determine the most competitive premium rates.

- Coverage Limits: Assess the extent of protection provided for your vehicle.

- Deductible: Understand how much you would need to pay out of pocket in case of a claim.

- Payment Options: Explore the flexibility of payment plans offered by insurers.

Evaluating Insurer Reputation and Customer Service

When selecting the right car insurance policy, one pivotal aspect to ponder is the evaluation of the insurer’s reputation and the quality of their customer service. Insurance companies vary in their reputation for handling claims process, coverage limits, payment options, deductible rates, and customer service quality. Examining an insurer’s reputation among consumers and industry experts can provide valuable insights into their reliability and trustworthiness. Additionally, gauging the level of customer service offered by the insurer, including factors such as roadside assistance and handling uninsured motorist situations, is vital in ensuring a smooth and efficient experience in times of need. Researching and comparing reviews and ratings can help identify the best car insurance companies known for their reputable service and customer satisfaction.

Considering Discounts and Bundling Options

Considering the different discounts and bundling options available can have a substantial impact on the decision-making process when selecting the appropriate car insurance policy. To guarantee you make an informed choice, contemplate the following:

- Discounts: Seek out discounts such as safe driver, multi-vehicle, or good student discounts to lower your premiums.

- Bundling Options: Verify if bundling your car insurance with other policies like home or renters insurance can result in additional savings.

- Coverage Limits and Deductibles: Grasp how adjusting your coverage limits and deductibles can influence your premium and out-of-pocket costs.

- Payment Options and Claims Process: Assess the convenience of various payment options and the effectiveness of the claims process, including roadside assistance availability.

Making a well-informed decision considering these aspects can assist you in selecting the right car insurance policy.

State-Specific Car Insurance Requirements

When it comes to car insurance, understanding the state-specific requirements is essential. Each state has its own minimum coverage requirements that drivers must adhere to. Additionally, some states follow a no-fault insurance system, while others operate under an at-fault system, impacting how claims are handled.

Minimum Coverage Requirements by State

State-specific car insurance requirements dictate the minimum coverage drivers must carry to legally operate a vehicle on the roads within each state. When contemplating car insurance, it is essential to understand the specific coverage mandated by your state. Here are key factors to ponder regarding minimum coverage requirements by state:

- Auto Liability: Most states require liability coverage to help pay for injuries and property damage you cause to others in an accident.

- Inclusive Coverage: Some states may mandate inclusive coverage, which helps pay for damage to your car not caused by a collision.

- Uninsured Motorist: This coverage protects you if you’re in an accident with a driver who doesn’t have insurance.

- High-Risk Car Insurance: States may have specific requirements for drivers considered high risk, often necessitating SR-22 insurance.

No-Fault vs. At-Fault States

Understanding the distinction between no-fault and at-fault states is pivotal when considering state-specific car insurance requirements. In at-fault states, the driver responsible for the car accident is required to cover the damages. On the other hand, in no-fault states, each driver’s insurance company pays for their client’s injuries, regardless of fault. This impacts liability protection, coverage limits, claims processes, deductibles, payment options, and medical payments. Below is a comparison table showcasing the key differences between no-fault and at-fault states:

| Aspect | No-Fault States | At-Fault States |

|---|---|---|

| Liability Protection | Each driver’s insurance covers their injuries | At-fault driver responsible for damages |

| Claims Process | Each driver deals with their insurance company | At-fault driver’s insurance pays for damages |

| Coverage Limits | Coverage limits may vary per policy | Coverage limits depend on the at-fault driver’s policy |

| Payment Options | Medical payments covered by the driver’s insurance | Medical payments covered by at-fault driver’s insurance |

State-Specific Insurance Programs and Alternatives

An in-depth examination of the intricate nuances within State-Specific Insurance Programs and Alternatives reveals essential insights into the distinct car insurance requirements mandated across various regions. State regulations play a pivotal role in shaping insurance options for drivers. Understanding state-specific coverage and insurance alternatives is important for compliance with regional insurance policies. Here are some key points to keep in mind:

- State Insurance Plans: Each state may offer specialized insurance programs tailored to its unique requirements.

- Coverage Requirements: State-specific coverage mandates dictate the minimum insurance requirements drivers must adhere to.

- Insurance Alternatives: Drivers may have access to alternative insurance options beyond traditional policies.

- Regional Insurance Policies: Different regions may have specific regulations that impact the type of coverage available to drivers.

The Car Insurance Claims Process

The car insurance claims process is a critical aspect of maneuvering through the aftermath of a vehicle-related incident. Understanding the steps to take immediately after an accident and how to file a car insurance claim are fundamental in ensuring a smooth process. Additionally, comprehending the roles of claims adjusters, the settlement process, and methods of dispute resolution and appeals are essential components to keep in mind in the claims process.

Steps to Take Immediately After an Accident

In the aftermath of an accident, it is important to promptly take specific steps to navigate the car insurance claims process efficiently and effectively. Here are the essential actions to contemplate:

- Check for Injuries: Confirm everyone involved is safe and seek medical assistance if needed.

- Contact Authorities: Report the accident to the police and gather relevant information.

- Document the Scene: Take photos, exchange insurance details, and gather witness information.

- Notify Your Insurance Company: Inform them about the accident, providing necessary details to initiate the claims process.

Taking these steps promptly can help streamline the insurance claim process and ensure a smoother resolution.

How to File a Car Insurance Claim

Steering the process of submitting a car insurance claim demands a careful and methodical approach to guarantee a swift and efficient resolution. When filing a car insurance claim, the policyholder needs to adhere to specific steps to ensure a smooth claim settlement process. This typically involves notifying the insurance company promptly, providing necessary documentation such as accident documentation and proof of loss, completing a claim form accurately, and cooperating with the claim adjuster assigned by the insurance company. Below is a table summarizing the key steps involved in the car insurance claim process:

| Step | Description | Importance |

|---|---|---|

| Notify Insurance Company | Inform the insurance company of the claim | Critical |

| Provide Documentation | Submit accident documentation and proof of loss | Essential |

| Complete Claim Form | Fill out the claim form accurately | Mandatory |

| Cooperate with Adjuster | Work with the claim adjuster for claim settlement | Vital |

| Review Insurance Coverage | Understand your insurance coverage and limits | Crucial |

The Role of Claims Adjusters

Playing an important role in the car insurance claims process, claims adjusters are responsible for evaluating and determining the extent of coverage for a claim. Here are some key aspects of their role:

- Assessing Damage: Claims adjusters inspect the vehicle to evaluate the extent of damage resulting from a car accident.

- Determining Liability: They investigate the accident to establish fault and determine the level of liability protection available under the insurance policy.

- Explaining Coverage Limits: Claims adjusters clarify the coverage limits outlined in the policy and how they apply to the specific claim.

- Reviewing Payment Options: They discuss deductible amounts, payment options, and any available additional services such as uninsured motorist coverage or roadside assistance.

Understanding the Settlement Process

Getting through the car insurance claims process involves a thorough understanding of the settlement procedures and intricacies involved. When a car accident occurs, the policyholder needs to review their insurance policy to understand the extent of their vehicle coverage and liability protection. It is crucial to be aware of coverage limits, deductibles, and the types of coverage such as all-encompassing coverage. The claims process typically involves notifying the insurance companies, providing relevant information and documentation, and working with adjusters to assess the damages. Familiarizing oneself with the terms of the auto insurance policy can streamline the process and ensure a smoother settlement. Understanding these aspects can help expedite the resolution of claims.

Dispute Resolution and Appeals

Dispute resolution and appeals are integral components of the car insurance claims process, providing avenues for policyholders to address disagreements or challenges that may arise during the settlement procedure. When facing issues with insurance claim denial or coverage disputes, understanding the appeals process becomes essential. Here are key steps to keep in mind:

- Review your insurance policy terms carefully.

- Seek resolution through the arbitration process if necessary.

- Contact the insurance ombudsman or regulatory authority for assistance.

- Familiarize yourself with consumer protection laws to safeguard your rights.

Tips for Lowering Car Insurance Premiums

To effectively lower car insurance premiums, individuals can consider implementing various strategies such as practicing safe driving habits, enrolling in defensive driving courses, and investing in safety and anti-theft devices for their vehicles. Additionally, maintaining a favorable credit score, choosing higher deductibles, and regularly reviewing and updating insurance policies are key factors that can contribute to reducing insurance costs over time. By proactively incorporating these measures into their insurance approach, policyholders can potentially secure more affordable coverage options while maintaining adequate protection for their vehicles.

Safe Driving Practices and Defensive Driving Courses

Implementing safe driving practices and completing defensive driving courses are effective strategies for reducing car insurance premiums while enhancing road safety. Here are some key points to take into account:

- Safe Driving Practices:

- Maintain a clean driving record to demonstrate responsible behavior.

- Adhere to traffic laws and regulations to avoid accidents.

- Drive defensively to anticipate and prevent potential hazards.

- Defensive Driving Courses:

- Offered by many insurance companies to enhance driving skills.

- Completion can result in premium discounts.

- Learn techniques to handle challenging driving situations effectively.

Installing Safety and Anti-Theft Devices

With advancements in technology, one effective strategy for reducing car insurance premiums is through the installation of safety and anti-theft devices in vehicles. Installing safety devices such as airbags, anti-lock brakes, and electronic stability control can help lower the risk of accidents and potential injuries, leading to potential discounts on auto insurance premiums. Anti-theft devices like alarms, tracking systems, and steering wheel locks help deter theft and vandalism, making the vehicle less risky to insure. Insurance companies often offer discounts for vehicles equipped with these devices as they reduce the likelihood of filing claims. Additionally, having these devices can also impact the deductible, claims process, coverage limits, and payment options associated with comprehensive coverage in your car insurance policy.

Maintaining a Good Credit Score

Enhancing one’s credit score can serve as a pivotal factor in reducing car insurance premiums for individuals seeking cost-effective coverage options. To maintain a good credit score and lower insurance costs, consider the following tips:

- Regularly monitor your credit report: Stay informed about your credit standing to address any inaccuracies promptly.

- Pay bills on time: Timely payments positively impact your credit score and insurance rates.

- Keep credit card balances low: High balances relative to your credit limit can negatively affect your score.

- Avoid opening multiple new accounts: Opening many accounts in a short period can lower your score.

Opting for Higher Deductibles

Maintaining an ideal credit score is beneficial not only for securing favorable car insurance premiums but also for considering strategies such as opting for higher deductibles to further lower insurance costs. A deductible is the amount a policyholder must pay out of pocket before their insurance company covers the remaining costs in the event of a claim. By choosing a higher deductible on your insurance policy, you can often enjoy lower monthly premiums. However, it is important to make sure you have sufficient funds set aside to cover the deductible if needed. Understanding coverage limits, the claims process, payment options, and the types of coverage available such as extensive coverage, collision insurance, and liability protection can help you navigate high-risk car insurance options and find the best car insurance companies.

Regular Policy Reviews and Updates

Are you maximizing your savings on car insurance premiums through regular policy reviews and updates? To lower your car insurance costs, consider these tips:

- Review Your Coverage Limits: Make sure you have adequate coverage for your vehicle and personal needs.

- Adjust Your Deductible: Increasing your deductible can lower your premiums, but make sure you can afford the out-of-pocket cost.

- Update Your Vehicle Coverage: Evaluate if collision and full coverage are necessary based on your vehicle’s value.

- Explore Payment Options: Some insurers offer discounts for paying annually or through automatic withdrawals.

Common Car Insurance Myths Debunked

In the domain of car insurance, several myths persist despite factual evidence debunking them. Misconceptions surrounding comprehensive coverage, the belief that red cars cost more to insure, and the misunderstanding that personal auto insurance covers business use are prevalent. These myths often lead to misinformation and can impact individuals‘ insurance decisions, making it important to address and clarify them.

Full Coverage Misconceptions

Despite common beliefs about what ‘full coverage’ entails in car insurance, it is important to debunk the misconceptions surrounding this term to understand the actual extent of coverage it provides. Here are some key points to clarify the concept of ‘full coverage’:

- Full coverage does not mean every possible type of coverage is included.

- It typically includes extensive and collision insurance.

- Essential protection is a critical component of full coverage.

- Full coverage policies have deductible amounts and coverage limits that vary among insurance companies.

Understanding these aspects is essential for policyholders to grasp the extent of their coverage, navigate the claims process effectively, and choose suitable payment options.

Red Cars Cost More to Insure

Contrary to popular belief, the color of a car, such as red, does not directly impact the cost of insurance premiums. Insurance companies determine auto insurance rates based on various factors such as driving history, age, make and model of the vehicle, and location. The color of a car is not a significant factor in calculating insurance premiums. It is essential to focus on elements like the car’s make, model, safety features, and the driver’s history to determine insurance costs accurately. While red cars may be flashy and draw attention, they do not inherently increase insurance costs. Hence, when selecting a car insurance policy, consider relevant factors that truly influence insurance premiums rather than the color of the vehicle.

Personal Auto Insurance Covers Business Use

While car color may not affect insurance premiums, an important myth to debunk is the misconception that personal auto insurance covers business use. When it comes to auto insurance, using your vehicle for business purposes requires specific coverage to protect you adequately. Here are some critical points to take into account:

- Personal auto insurance typically excludes coverage for business use.

- Business use includes activities like delivering goods, ridesharing, or transporting clients.

- Without proper coverage, you may face denied claims and potential financial losses.

- Insurance companies offer commercial auto policies tailored to business needs, including higher liability protection and coverage limits.

Understanding the distinctions between personal and business auto insurance is vital to make sure you have the right protection in place.

Car Insurance for Special Circumstances

Car insurance for special circumstances encompasses tailored coverage options for high-risk drivers, classic and collector car owners, as well as teen and elderly drivers. Additionally, specialized insurance products are available for individuals working in the rideshare and delivery driver sectors. These unique policies address the specific needs and risks associated with these particular groups of drivers.

Insurance for High-Risk Drivers

For drivers with a history of traffic violations or accidents, obtaining insurance coverage can be challenging due to being classified as high-risk individuals. When looking for insurance as a high-risk driver, consider the following key points:

- SR-22 Insurance: Often required for high-risk drivers to prove financial responsibility to the state.

- DUI Car Insurance: Specific coverage for individuals with a driving under the influence offense.

- Liability Protection: Essential coverage to protect assets in case of an at-fault accident.

- Payment Options: Some insurers offer flexible payment plans to help manage insurance costs effectively.

Navigating the claims process, understanding coverage limits, deductibles, and researching the best car insurance companies are important for high-risk drivers seeking appropriate coverage.

Classic and Collector Car Insurance

In the domain of insurance coverage tailored to unique automotive assets, Classic and Collector Car Insurance offers specialized protection for vehicles of historical or significant value. Vintage vehicle coverage, also known as antique car insurance, provides specialized coverage through agreed value policies tailored to the specific needs of classic car owners. Policies often include features such as limited mileage allowances, restoration coverage, and protection through classic car clubs. This type of insurance is designed to safeguard historical vehicles from potential risks while recognizing their exceptional value. Classic and Collector Car Insurance guarantees that these cherished automobiles have the necessary coverage for their unique requirements, offering thorough protection for historical vehicle owners.

Insurance for Teen and Elderly Drivers

Amidst the diverse domains of specialized automotive insurance, policies tailored for teen and elderly drivers present a distinct focus on addressing the unique risk profiles and driving behaviors associated with these specific age groups. When it comes to insurance for teenage drivers and elderly drivers, there are specific considerations to keep in mind:

- High-Risk Drivers: Teenage drivers are often categorized as high-risk due to their lack of experience, while elderly drivers may face increased risk due to age-related factors.

- Insurance Rates: Both teenage and elderly drivers may experience higher insurance rates compared to other age groups.

- Safe Driving Discounts: Insurance companies may offer safe driving discounts for both teenage and elderly drivers who maintain a clean driving record.

- Driver Training Programs and Age-Related Discounts: Programs tailored for teenage and elderly drivers may offer discounts and coverage options to address their specific needs.

Rideshare and Delivery Driver Insurance

Guaranteeing proper coverage for rideshare and delivery drivers under their car insurance policies necessitates a thorough understanding of the unique risks and liabilities associated with operating a vehicle for commercial purposes. Rideshare insurance and delivery driver insurance are specialized forms of commercial auto insurance designed to provide coverage beyond personal auto policies. Coverage options may include liability coverage for bodily injury and property damage, accident coverage, and additional protection for vehicles used in ride-hailing services or food delivery services. Insurance policy requirements for drivers working in these capacities often mandate specific levels of coverage to address the heightened risks involved. It is vital for drivers engaging in these activities to review their policies carefully and make certain they have the appropriate coverage to protect themselves and others on the road.

Frequently Asked Questions

Can I Insure a Car That Is Not in My Name?

While it is possible to insure a vehicle not in your name, it typically requires the owner’s consent and may have limitations. Policies vary by insurer and jurisdiction, so it’s important to review terms carefully to guarantee compliance.

What Happens to My Car Insurance if I Move to a Different State?

When relocating to a new state, it’s crucial to inform your insurance provider promptly. Shifts in location can affect policy rates and coverage requirements. Evaluating and adapting your insurance needs accordingly can help guarantee seamless coverage and compliance.

Will My Car Insurance Cover Me if I Am Driving for a Rideshare Company Like Uber or Lyft?

Typically, personal auto insurance policies do not cover commercial activities like ridesharing. Driving for companies such as Uber or Lyft may require additional coverage, as it falls under a different risk category. Contact your insurance provider for specific details.

Can I Add Custom Modifications to My Car and Still Be Covered by My Insurance?

Altering a vehicle with custom features may influence insurance coverage. Refer to your policy terms and insurer to confirm modifications are compliant. It’s essential to disclose alterations to accurately assess risk and maintain proper coverage.

What Is the Difference Between an Insurance Broker and an Insurance Agent When It Comes to Purchasing Car Insurance?

An insurance broker typically represents multiple insurance companies and helps clients find suitable policies. They offer independent advice and can compare quotes. In contrast, an insurance agent is usually employed by a single insurer, selling policies directly to customers.